Former RBI Governor appointed Principal Secretary-II to PM

Dr P K Mishra is the Principal Secretary-I to the Prime Minister.

Three auctions of government securities conducted by RBI got devolved as market participants stayed away from buying bonds.

In the second half of this fiscal, the government will borrow Rs 4.34 lakh crore to meet its expenditure requirement. (Photo: IANS)

With higher government borrowing resulting in increased supply of government securities, the Reserve Bank of India on Friday said it is ready to conduct market operations to assuage pressures arising out of it and dispel any illiquidity in financial markets.

In May, the government increased its market borrowing programme for the current financial year by more than 50 per cent to Rs 12 lakh crore from Rs 7.80 lakh crore announced in the Budget 2020-21.

Advertisement

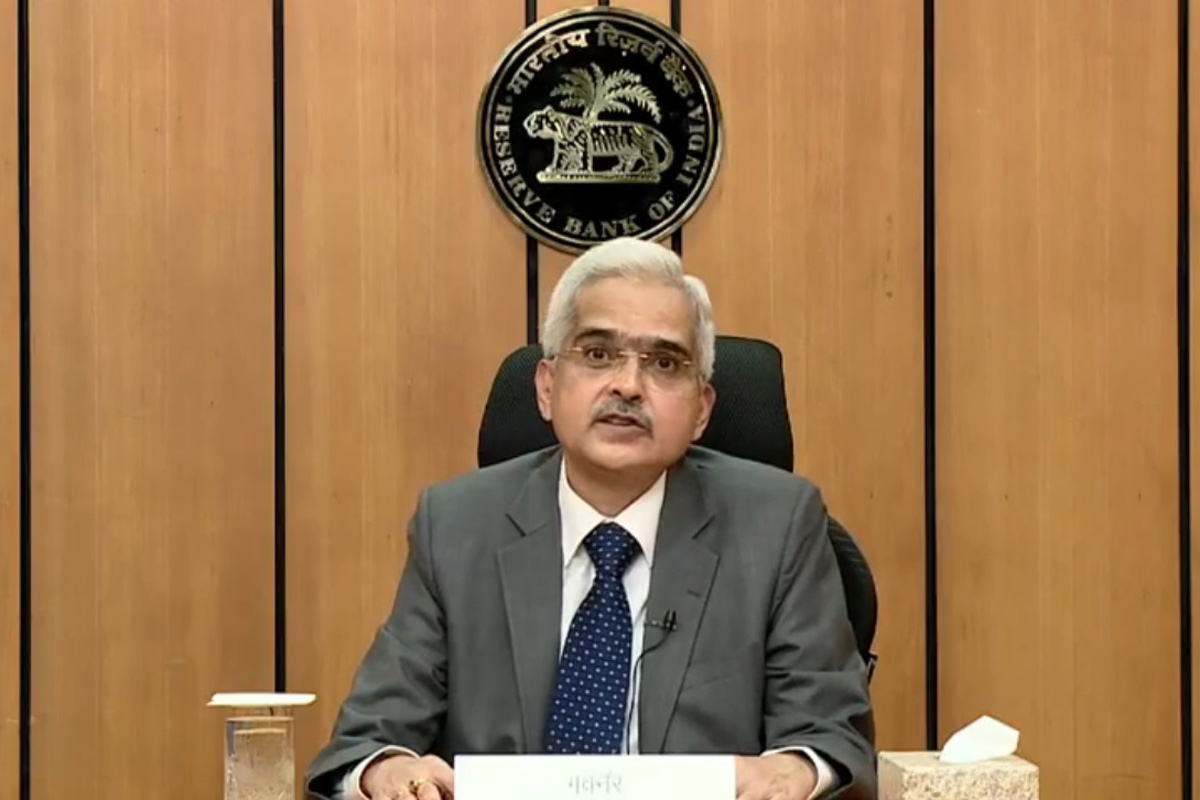

While announcing the monetary policy, RBI Governor Shaktikanta Das said the augmented borrowing programme for 2020-21 has been necessitated due to the exigencies imposed by the pandemic in the form of the fiscal stimulus and the loss of tax revenue.

Advertisement

“While this has imposed pressures on the market in the form of expanded supply of paper, the RBI stands ready to conduct market operations as required through a variety of instruments to assuage these pressures, dispel any illiquidity in financial markets and maintain orderly market conditions,” Das said.

The governor also urged market participants to take a broader time perspective and display bidding behaviour that reflects a sensitivity to the signals from RBI in the conduct of monetary policy and debt management.

In the past, three auctions of government securities conducted by RBI got devolved as market participants stayed away from buying bonds.

“We look forward to cooperative solutions for the borrowing programme for the second half of the year. It is said that it takes at least two views to make a market, but these views can be competitive without being combative,” Das said.

In the second half of this fiscal, the government will borrow Rs 4.34 lakh crore to meet its expenditure requirement. In the first half ended September, it had borrowed Rs 7.66 lakh crore.

“RBI has assured that the borrowing programme of the centre and states for rest of 2020-21 will be completed in a non-disruptive manner without compromising on price and financial stability,” Das said.

According to him, market participants should be assured that in keeping with the monetary policy stance announced today, RBI will maintain comfortable liquidity conditions and will conduct market operations in the form of outright and special open market operations.

He said that in response to feedback from market participants, the size of these auctions will be increased to Rs 20,000 crore.

“It is expected that the market participants will respond positively to this initiative,” Das said.

RBI has also announced purchasing four securities worth Rs 20,000 crore under open market operations on October 15.

The securities which the central bank will buy include “6.97 per cent-2026, 7.17 per cent-2028, 5.79 per cent-2030 and 7.57 per cent-2033”.

Advertisement