Market ends flat in rangebound session amid tariffs concern

At close, the Sensex was down 7.51 points or 0.01% at 74,332.58, and the Nifty was up 7.80 points or 0.03% at 22,552.50. For the week, BSE Sensex added 1.5% and Nifty jumped 2%.

Sensex

Shares of large state-run banks such as State Bank of India, Bank of Baroda and Punjab National Bank were hit by selling pressure today as many bankers and brokers felt the allocation of funds under the Rs 2.11-lakh-crore recapitalisation plan to these lenders was not up to their estimates and below their requirements of fresh capital.

Besides, the finance minister, Mr Arun Jaitley, who released details of the recapitalisation plan yesterday, asked public sector banks to simultaneously take up reforms to complement infusion of fresh capital.

Advertisement

Compared to big staterun lenders, medium and small banks were given a better treatment in terms of allocation of recap funds, say bankers. Analysts also blame rise in Brent Crude prices to $71/ per barrel and expiry of January’s F&O derivatives for the reversal in stock rally.

Advertisement

Stocks of SBI, PNB, BoB and some other lenders cracked as much as 5.5 per cent in morning deals immediately after Dalal Street opened for the trade. A series of banking reforms spelt out by the finance minister were earlier also emphasised by the Reserve Bank of India, particularly by deputy governor Mr Viral Acharya on several occasions.

Global agency Jefferies looks in agreement with the government and the RBI as it commented: “We believe this is overall positive for the banking sector but not exactly in tune with the Dalal Street’s expectations.” Private banks bucked the trend and rose as investors shifted from PSBs to private banks.

The Nifty Bank of National Stock Exchange rose to 27,500.35 points, up 101.80 points or 0.39 per cent while the Nifty PSU Bank cracked 5.24 per cent or 207.90 points to end at 3,757.70 points. Brokers have asked their clients to be judicious about picking up bank shares at least in near to medium terms unless the impact of recap plan ~ how it is implemented by banks ~ plays out.

Two more negatives ~ rise in Brent Crude prices to $71 per barrel and volatility accompanying expiry of January’s F&O derivatives series ~ weighed on the 30-share Sensitive Index of Bombay Stock Exchange and the 50-scrip Nifty of National Stock Exchange. But the decline was marginal compared to the bull run so far in 2018.

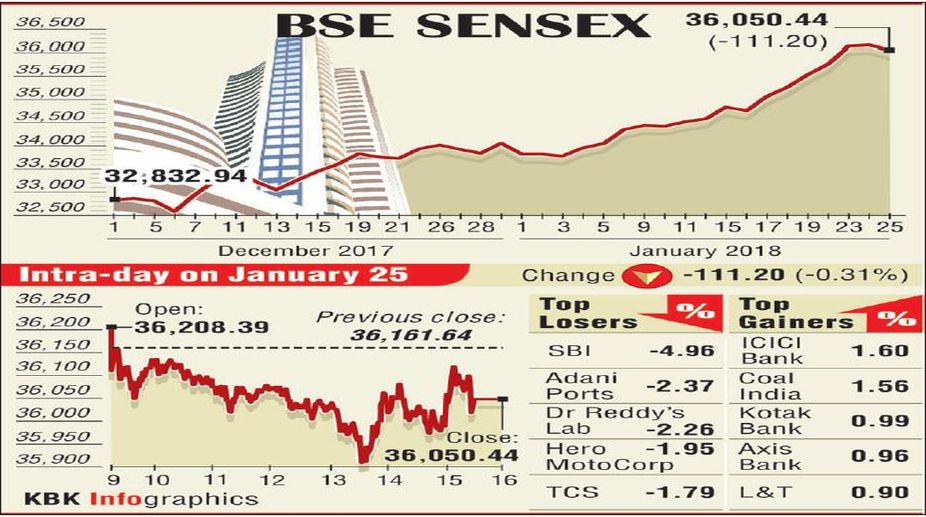

The Sensex closed for the week at 36,050.44 points, registering a decline of 111.20 points or 0.34 per cent. The Nifty lost 0.15 per cent or 16.35 points to finish at 11,069.65 points. In the Sensex pack, 11 shares were up and 20 were down. In the Nifty, the advance-decline ratio stood at 24 versus 26. Next week Mr Jaitley will present the Budget 2018-19 to Parliament.

The market is agog with speculations and expectations as each sector looks forward to derive some succour from the annual exercise. However, a host of theory spinners have failed to dent positive mood in Dalal Street which can be ascertained from the continuing rally.

The biggest domestic institutional investor or DII Life Insurance Corporation of India, analysts say, had been big buyer in October-December quarter. The state-run insurer is believed to have shopped in IT, FMCG, oil and gas and banks and financial shares, increasing its stakes across the board.

Gainers in the BSE benchmark included ICICI Bank at Rs 361.75, up 2.58 per cent; Coal India at Rs 300.50, up 1.85 per cent; Kotak Mahindra Bank at Rs 1,092.45, up 1.09 per cent and HDFC Bank at Rs 1,975, up 0.78 per cent. SBI was the biggest loser at Rs 313.70, down 4.80 per cent.

Advertisement