Market closes lower due to losses in consumer stocks amid weak earnings

The stock market closed lower on Wednesday due to losses in consumer stocks amid weak earnings.

All the sectors faced profit booking decline except IT, FMCG and Pharma counters. At around 2.00 p.m., the S&P BSE Sensex trade on a flat note at 55,617.55.

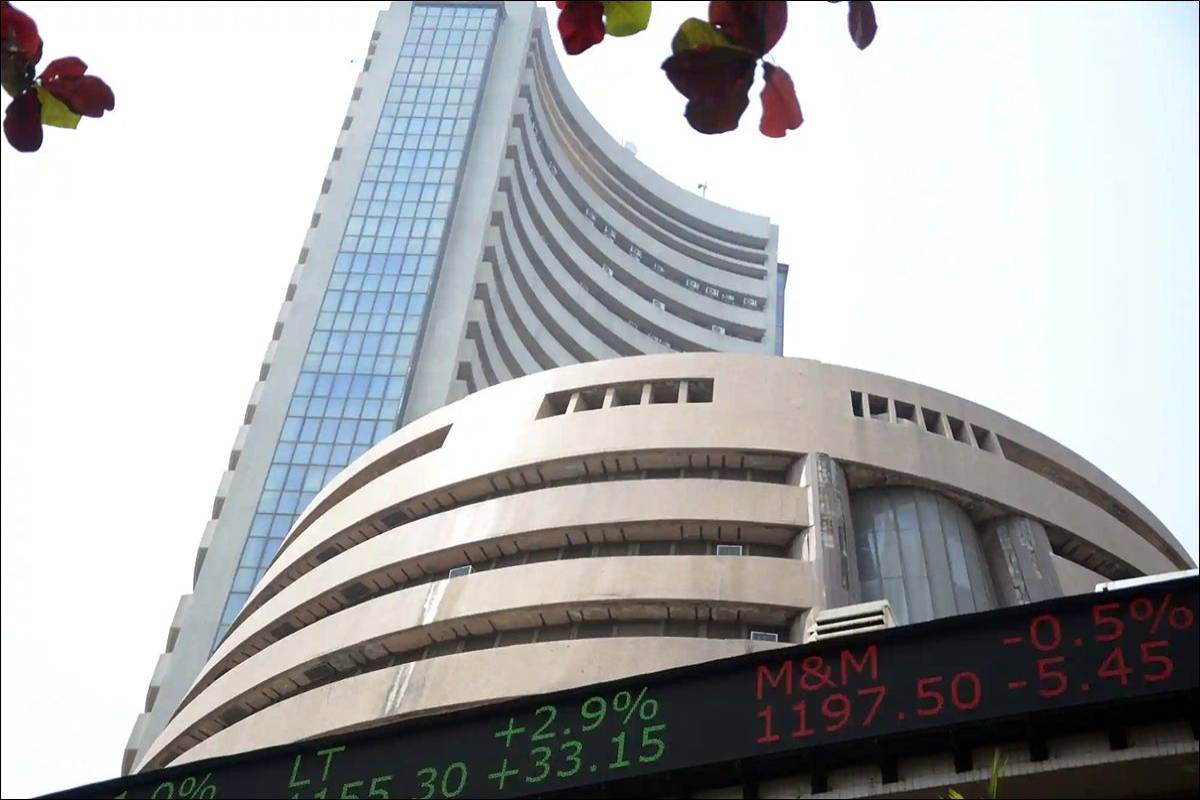

(File Photo)

Profit booking subdued India’s key equity market indices during the mid-afternoon trade session on Wednesday.

Accordingly, market breadth turned weak as mid and smallcaps fell due to profit booking.

Advertisement

The key indices opened on a flat note. They gradually rose to touch record high levels.

Advertisement

Consequently, the NSE Nifty50 touched a record high of 16,591.4 points, while S&P BSE Sensex reached 55,688.5 points during the session.

Nevertheless, profit booking and negative Asian cues dented sentiments.

All the sectors faced profit booking decline except IT, FMCG and Pharma counters.

At around 2.00 p.m., the S&P BSE Sensex trade on a flat note at 55,617.55, up by just by 34.97 points or 0.063 per cent from its previous close.

However, the NSE Nifty50 closed at 16,561.55, slipping by (-) 1.50 points or 0.0091 per cent from its previous close.

“Nifty opened flattish and crossed its previous day’s high to touch a new life time high of 16591 levels but facing slight profit booking decline. It is respecting 16500 levels but facing hurdles at 16600 zones and moving in a range of 75 points. Even after touching a new high, follow up action is missing in the market,” said Chandan Taparia, Technical and Derivatives Analyst, MOFSL.

“Volatility is slightly on the higher side above 13.5 levels and creating some nervousness. Till the index holds 16500, it can move towards 16700 and 16750 levels whereas support can be seen at 16,400 then 16,250 zones. Market breadth has turned in favor of the declining counters.”

According to Deepak Jasani, Head of Retail Research, HDFC Securities: “Asian markets are all in the negative amid concern about turmoil in Afghanistan and unease about China’s economic outlook after weak July activity.”

“Chinese factory output, consumer spending and investment grew slower in July than expected.”

Advertisement