The main equity gauges of Bombay Stock Exchange and National Stock Exchange slumped from their intra-day highs today as strong selling pressure set in across the board following finance minister Nirmala Sitharaman’s flat refusal to either withdraw or cut Income Tax surcharge on earnings of foreign portfolio investors’ income exceeding Rs 3 crore. The passage of the Finance Bill 2019-20 by Parliament yesterday evening without any worthwhile amendments made it clear that the government would not budge to request/pressure from FPIs.

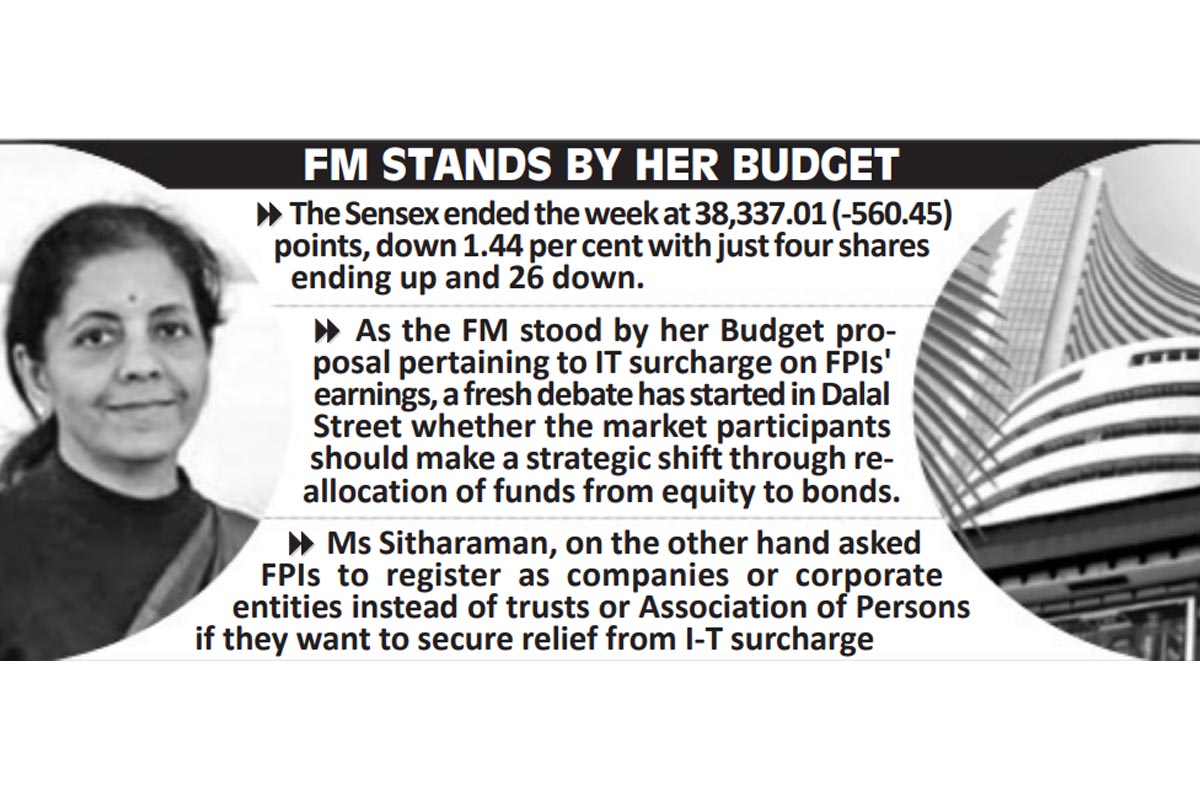

38,337.01 (-560.45) points, down 1.44 per cent with just four shares ending up and 26 down. Nifty tanked 1.53 per cent to close at 11,419.25 (- 177.65) points. In broader market index seven shares were in green and 43 in red. Nifty Bank settled at 29,770.35 (-660.25) points falling 2.17 per cent. The top losers in BSE benchmark included Mahindra & Mahindra at Rs 571, down 4.42 per cent; Bajaj Finance at Rs 3,320, down 4.22 per cent; Kotak M Bank at Rs 1,567.05, down 1.93 per cent and SBI at Rs 357.35, down 1.73 per cent.

Advertisement

As the FM stood by her Budget proposal pertaining to IT surcharge on FPIs’ earnings, a fresh debate has started in Dalal Street whether the market participants should make a strategic shift through re-allocation of funds from equity investments to 10-year benchmark government debts which are now being used by the government to raise $10 billion via off-shore sale. Analysts see a hint by the government asking investors to go for bonds which are more attractive under present environment of economic slowdown, not only in the domestic economy but also globally.

Bond yields have fallen to 6.3 per cent or about 110 basis points (1.1 per cent) from the recent high. Analysts see a clear message to FPIs that they should either change over to corporate entity and escape IT surcharge or start buying benchmark bonds. Domestic brokerages have always taken exception to FPIs ‘plundering’ equity markets with massive profits.

Ms Sitharaman, on the other hand asked FPIs to register as companies or corporate entities instead of trusts or Association of Persons if they want to secure relief from IT surcharge. The other reasons for today’s brisk sell-off was definite signs of global slowdown in economy and trade following Japan reporting a slump in exports as well as imports and concerns over deadlock in trade talks between the United States and China. Analysts say even earnings data in Europe has been disappointing hitting the equity indices in London, France and Germany. Yesterday Nikkei of Japan also fell nearly 2 per cent. In July FPIs have withdrawn Rs 5,526.44 crore (Rs 1,404.86 crore yesterday) while DIIs are net buyers of Rs 5,838.55 crore, according to NSE data.

The only positive development for the day has been that the US Fed vice-chairman, who heads interest rate setting panel, has made a strong pitch for aggressive lowering of Fed’s rate cut in the next 10 days. However, the hint did not lift global markets’ mood.