Market Reality

India's equity markets, long buoyed by strong economic growth and rising corporate earnings, are now facing a sharp and prolonged correction.

The Nifty50 on the National Stock Exchange closed at 11,359.90, at 114.55 points lower. Sensex closed at 38,305.41, at 361.92 points lower, or by 0.94 per cent.

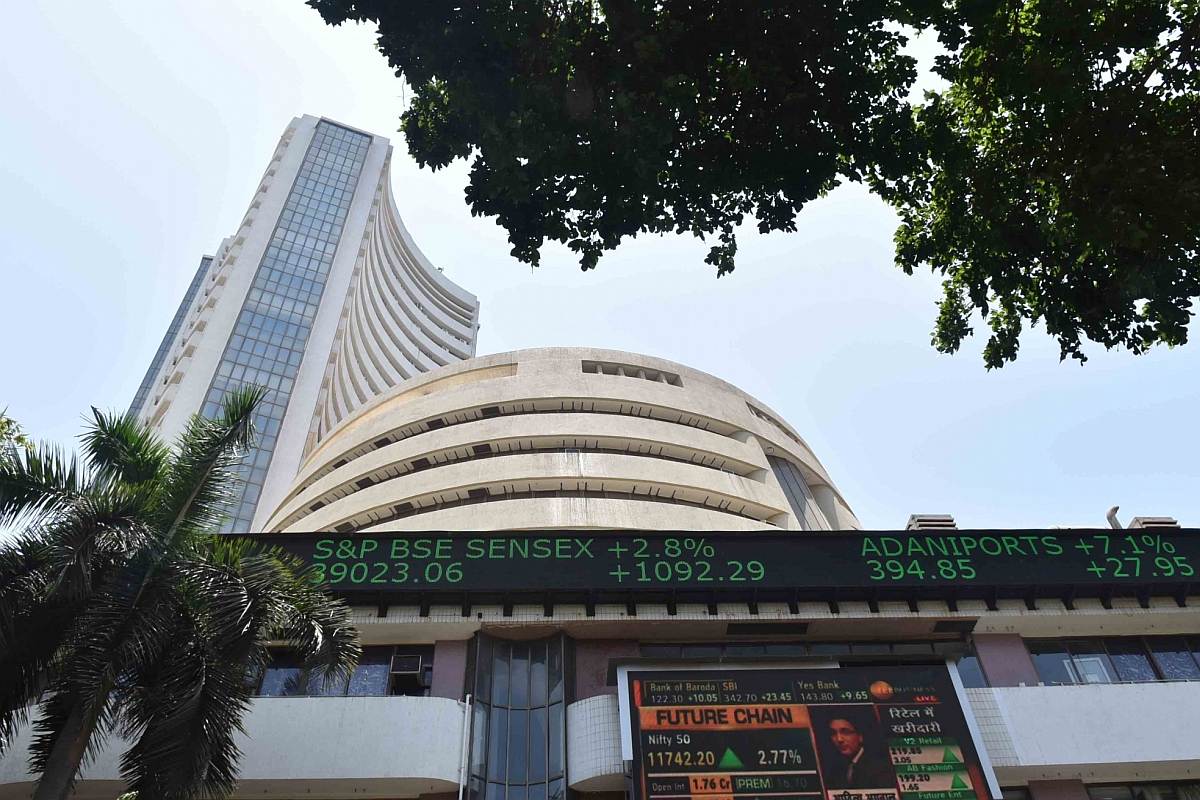

(Photo: IANS)

The BSE Sensex slumped over 700 points on Tuesday afternoon on heavy selling across sectors led by banking and financial stocks.

The markets, however, recovered from the lows, the Sensex closed at 38,305.41, at 361.92 points lower, or by 0.94 per cent, than its previous close of 38,667.33.

Advertisement

Around 2.13 p.m. the index fell 737.44 points to touch an intra-day low of 37,929.89 points. It has touched a high of 38,813.48 so far.

Advertisement

The Nifty50 on the National Stock Exchange closed at 11,359.90, at 114.55 points lower, or by 1 per cent, than the previous close.

Yes BankNSE -22.71 % was the biggest index loser, tumbling over 22 per cent after its promoter entities sold a part of their stake in the company.

The rupee was also weak amid heavy selling in equity market, down 0.28 per cent or 20 paise at 71.06. The volatility index, India VIX surged 11.54 per cent in the afternoon trade to hit 17.7 level.

Here are the key factors that weighed on Dalal Street today:

Banks bleed

Banking names crashed on Tuesday as Nifty Bank came down by 2.44 per cent led by YES Bank that plummeted over 22 per cent. RBL BankNSE -8.97 % also tumbled 18 per cent on NSE. Except for HDFC BankNSE 1.74 %, all constituents of the index were trading in the red.

Rumours of more distressed names coming out weighed on the banks. Banking stocks fell on Monday as well on buzz of their exposure to IndiabullsNSE -9.97 % Group.

YES Bank, Bank of BarodaNSE -1.88 %, SBI, IndusInd BankNSE -6.18 % and RBL Bank are amongst the banks that are most prone to high risk emanating from Anil Dhirubhai Ambani Group (ADAG), Cox & Kings, CG Power, DHFL and Essar ShippingNSE -1.36 %, it said.

The other major losers were IndusInd Bank (down 5.5 per cent), State Bank of India (4.98 per cent), Bharti Airtel (4.52 per cent) and ONGC (2.72 per cent).

Auto sales stay sluggish

Auto sales continued to slide in September. Sales for M&M declined 21 per cent, SML Isuzu (26 per cent), Eicher Motors (30 per cent), Ashok Leyland (27 per cent). This dampened the mood dragging Nifty Auto 0.7 per cent.

However, a couple of companies registered a growth in monthly sales, including Escorts (up 2.2 per cent) Atul Auto (4 per cent).

(With input from agencies)

Advertisement