The political stand-off in Karnataka, along with the persistent rise in global crude oil prices and a large outflow of foreign funds, pulled the key Indian equity indices deep into the red in the week just-ended.

Even a weak rupee and higher-than-expected inflation scenario eroded investor sentiments.

Advertisement

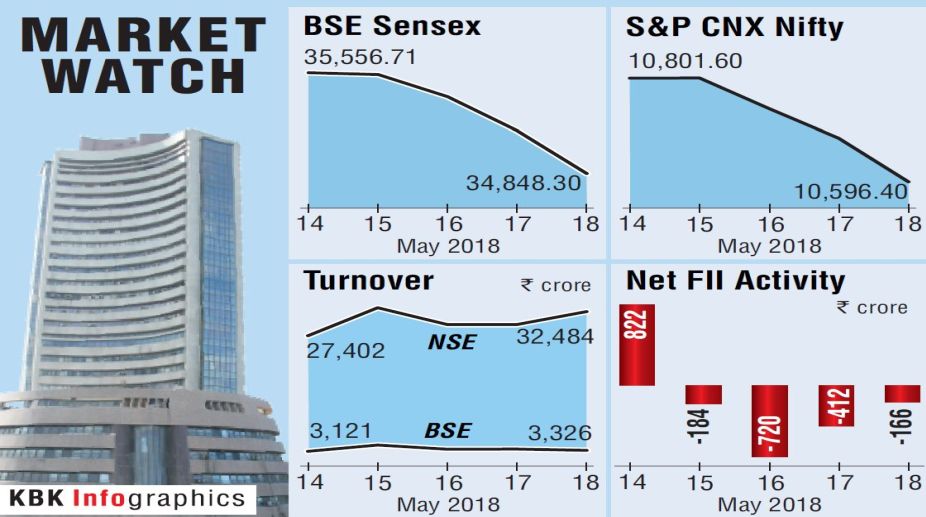

On a weekly basis, the barometer 30-scrip Sensitive Index (Sensex) of the BSE declined by a massive 687.49 points or 1.93 per cent to close at 34,848.30 points.

The wider Nifty50 of the National Stock Exchange (NSE) closed the week’s trade at 10,596.40 points ~down 210.1 points or 1.94 per cent ~from its previous close.

Session-wise, the market breadth was negative in four out of the five trading days of the week, analysts said.

“Market tumbled last week as investors booked profits amid political wrangling in Karnataka and firming crude oil prices,” said Prateek Jain, Director, Hem Securities.

“The political drama continues to unfold as the Supreme Court denied extension of time to BJP and announced floor-test on Saturday. If all this was not enough, rising inflation and rising bond yields continue to haunt the sentiments,” Jain added.

Equity99’s Senior Research Analyst Rahul Sharma told IANS: “Mixed cues from global markets and unabated foreign fund outflows added to the volatility.”

According to HDFC Securities’ Head of Retail Research, Deepak Jasani, markets ended lower as selling emerged from the Nifty’s high of 10,929 points. Globally, Sharma said that sentiments were tepid after “US President Donald Trump on Thursday said that China, Europe and other countries have become ‘very spoiled’ on trade and that the US cannot allow that to happen anymore”.

On the currency front, the rupee weakened by 68 paise to close at 68.01 against the US dollar from its previous week’s close of 67.33 per greenback.

In terms of investments, provisional figures from the stock exchanges showed that foreign institutional investors sold scrips worth Rs 1,496.79 crore, while the domestic institutional investors purchased stocks worth Rs 2,026.12 crore during the week.

Figures from the National Securities Depository (NSDL) revealed that foreign portfolio investors (FPIs) divested equities worth Rs 799.88 crore, or $117.63 million, in the week ended May 18. Sector-wise, the top gainer was the FMCG index and the top losers were public sector banks, infrastructure, energy and auto indices, Jasani told IANS.

The top weekly Sensex gainers were: Hindustan Unilever (up 6.49 percent at Rs 1,604.10); Power Grid (up 2.63 percent at Rs 212.65); Kotak Mahindra Bank (up 2.28 percent at Rs 1,294.25); IndusInd Bank (up 1.69 percent at Rs 1,926.20); and Asian Paints (up 1.35 percent at Rs 1,306.95 per share).

The major losers were: ICICI Bank (down 7.94 percent at Rs 286.40); Tata Motors (down 7.71 percent at Rs 305.25); Tata Motors (DVR) (down 7.49 percent at Rs 180.30); Bharti Airtel (down 6.16 percent at Rs 361.95); and Reliance Industries (down 5.57 percent at Rs 933.40 per share).