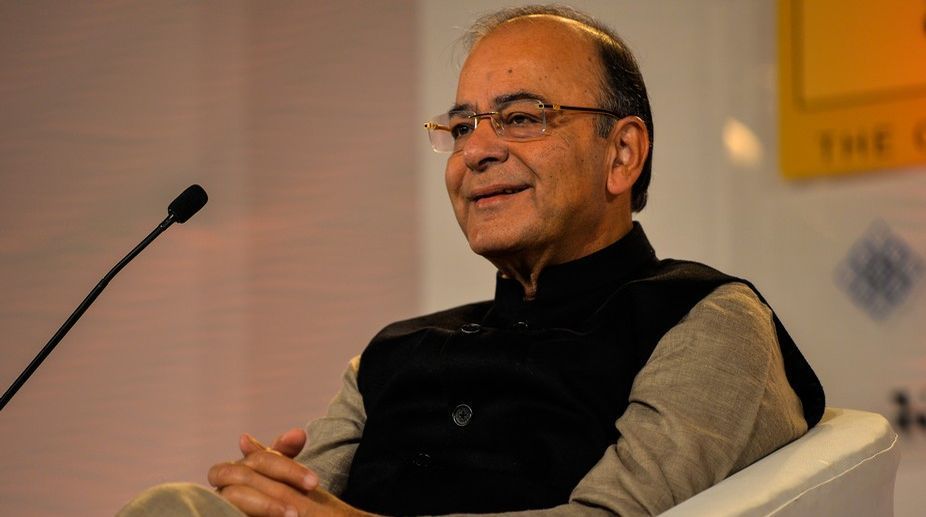

Finance Minister Arun Jaitley has urged Singaporean businesses to invest in India, highlighting the country as one of the largest FDI recipients with the government undertaking major structural reforms, including Aadhaar, GST and demonetisation.

“India has become the most favourable and attractive destination for Foreign Direct Investment (FDI),” Jaitley said while addressing an investors’ roundtable here on Wednesday.

Advertisement

He is on a two-day visit here. The roundtable was jointly organised by the Ministry of Finance and the High Commission of India in Singapore.

Jaitley said that to provide further impetus to the economy, “the present government has implemented a slew of economic reforms one after the other, including the Goods and Services Tax (GST) roll-out, introduction of Insolvency and Bankruptcy Code (IBC) and the recapitalisation package for the Public Sector Banks (PSBs)”.

He said these will help to redress the balance-sheet problem and revive private investment.

“The Finance Minister also spoke about the major initiatives undertaken, including the crackdown against black money through demonetisation and other follow-up measures and major changes in the FDI policy regime, with an aim to make it more liberal and investor-friendly,” the Finance Ministry said in a statement.

He also highlighted the “Ease of Doing Business” measures initiated in the last three years that resulted in India “jumping” in World Bank’s Index from 146 in 2014 to 100 in October 2017.

Earlier in his key note address at the Singapore Fintech Festival on Wednesday, Jaitley said the three key structural reforms “have brought transparency and efficiency in governance and helped in transition from cash to less cash economy and from informal to formal economy”.

He said the demonetisation move has helped in bringing out black money “by giving identity to anonymous cash”.

Jaitley also spoke on India’s growing economy, stable currency, liberalisation of FDI policies and attractiveness as a global destination for start-ups, among others.

He dwelt on how Aadhaar revolution coupled with financial inclusion and its potential applications in transferring of pension, scholarship and government subsidies directly to the actual beneficiaries under the Direct Benefit Transfer (DBT) Scheme is transforming the payment landscape in India.

Jaitley later met Tharman Shanmugaratnam, Deputy Prime Minister of Singapore, and discussed issues of mutual interest between the two nations.

He also met his Singaporean counterpart Heng Swee Keat and discussed key reforms being implemented by the Indian government, along with measures to increase mutual bilateral investments.

He met the CEO and senior officials of the Government of Singapore Investment Corporation (GIC) and discussed investment opportunities across multiple sectors in India, including the National Investment and Infrastructure Fund (NIIF).

Jaitley met the SIA and DBS Group Holdings Chairman, CEO of Singapore Airlines, Chairman of Blackstone and President of Singapore Stock Exchange and discussed multiple issues of mutual interest in the meeting.

The Finance Minister also visited the Singapore Expo, a global event organised by the Monetary Authority of Singapore (MAS) attracting over 35,000 fintech participants, showcasing state of the art developments in fintech and engaging professionals and policy makers on insightful debates on fintech developments across the globe.

Earlier, Jaitley visited the India pavilion set-up by Invest India, along with the state governments of Andhra Pradesh, Uttarakhand, West Bengal and Maharashtra, which are also participating in the Expo.