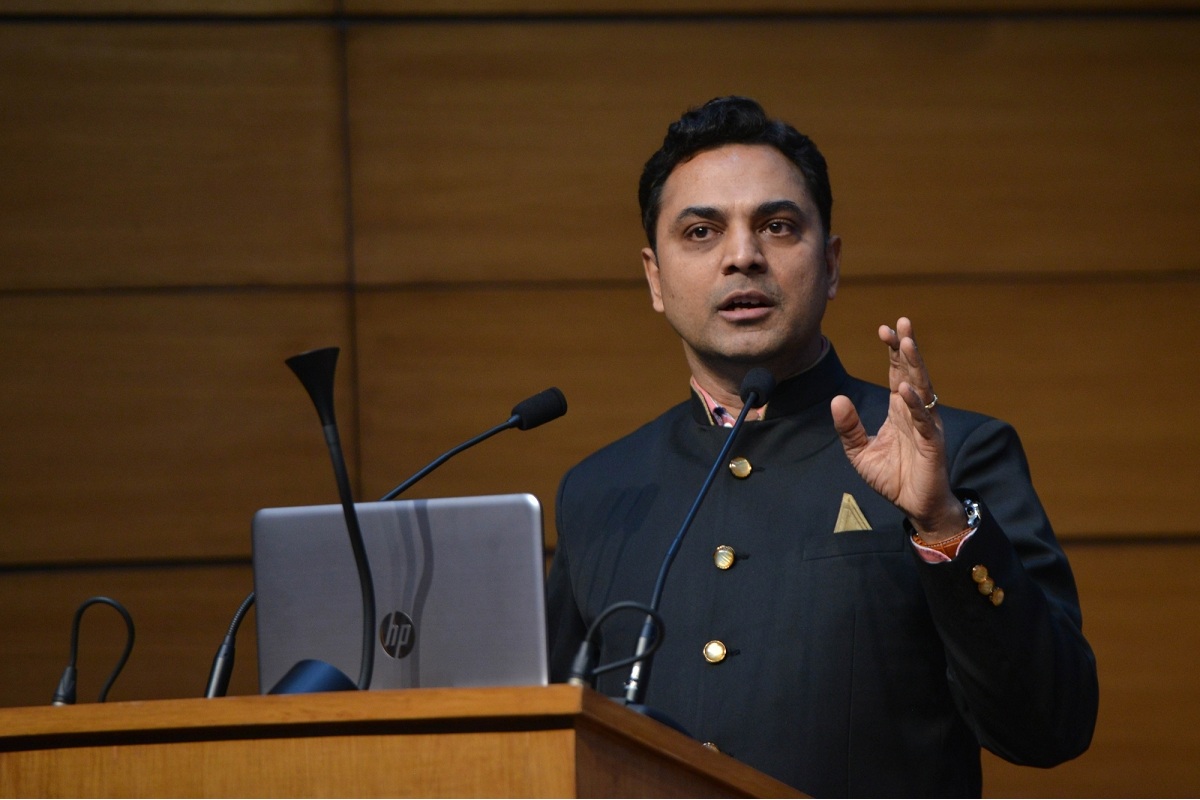

As the Yes Bank crisis weighs on investor sentiments, becoming a major reason of concern for the bank’s depositors, Chief Economic Adviser (CEA) Krishnamurthy Subramanian on Sunday said there is no reason to worry as India’s banks have adequate capital.

He also noted that ratio of deposit to M-CAP (market capitalisaion) is not the correct instrument for assessing the safety of banks and instead Capital to Risk (Weighted) Assets Ratio (CRAR) should be gauged.

Advertisement

The CEA said banking sector experts and regulators use CRAR among other metrics to gauge the financial health of banks, and Indian banks fare well in terms of CRAR.

“It is important to keep this in mind that the international norm for CRAR is 8 per cent and Indian banks on average have a CRAR of 14.3 per cent. So 8 per cent is the mandated minimum norm and our banks have 14.3 per cent. Now 14.3 versus 8 translates into almost 80 per cent greater capital than the international norm,” he said.

Describing that M-CAP ratio is not the right instrument to assess banks, he added: “The M-CAP ratio essentially is the ratio of the deposits that a bank has to the market capitalisation. Now if you compare, for instance, a private sector bank with the State Bank of India. SBI would have an order of magnitude of higher M-CAP ratio, but the SBI is as safe as any other bank in the world. It is the only Indian bank to be part of the top 100 banks internationally.”

He noted that M-CAP ratio is affected by market capitalisation and the stocks of the bank may change every minute,so the M-CAP ratio will also change frequently, but solvency cannot change that fast. Market capitalisation itself is affected by things such as the prospective growth of the bank, the interest margin, the efficiency of the banking operations, none of which have anything to do with the safety of the bank and these primarily affect future earnings, Subramanian added.

“What regulators and experts use is the CRAR and other assets are the debt-to-assets ratio. All of which are actually quite good for the Indian banks. Compared to the 8 per cent norm of CRAR, which is capital adequacy our banks have way more capital,” he said.

He observed that our banks on an average are “well capitalised” and there is no reason to worry.

“Together with the fact that our banks are well capitalised and the fact that the deposits are well taken care of, there is absolutely no reason for anyone to worry,” he said.

Investors and stakeholders in the Indian financial markets have been concerned after the Reserve Bank of India on Thursday placed Yes Bank under moratorium for 30 days and capped the withdrawal limit at Rs 50,000 because of deteriorating financial health of the private lender.

The apex bank on Friday released a draft reconstruction scheme for the bank as per which the State Bank of India would acquire up to 49 per cent stake in the bank.