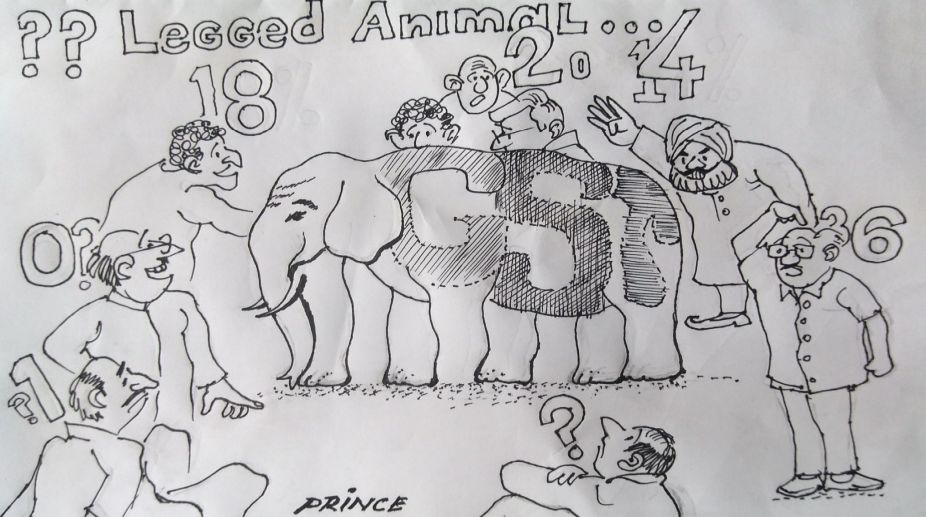

As the country braces for a new indirect tax regime in the form of Goods and Services Tax (GST), slated for launch on 30 June midnight, consumers will get a mixed bag in terms of its impact on the cost of commodities and services. There is excitement in the market and the common man is visibly anxious for obvious reasons. Here, we simplify its impact on the prices of a variety of products and services that matter the most for the common man.

HOUSE KITCHEN

Advertisement

The prices of the basic food items — cereals, rice, wheat, pulses, milk, sugar, tea, coffee, edible oil — will remain unaffected under the GST. The prices of biscuits, corn flakes and ice-creams will come down as the tax rate has been cut down by 14%. The tax has been slashed by 5% on chocolates.

NON-FOOD ITEMS

In the non-food section, prices of most commodities will come down, except for Ayurveda products and footwear with MRP above Rs. 500. Consumers will have to pay less for hair oil, bathing soaps, toothpaste, shampoo, face cream, silk and jute. The tax on cotton remains the same at 5%. Washing powder will be dearer. Tobacco users will have to pay more, too.

DURABLES

The cost of TV, fridge, washing machines, smartphones will come down as the tax has been slashed from 33% to 28%. However, the price of gold will go up slightly as the tax has been hiked by 1%.

BASIC SERVICES

This is an area of concern for the common man as services, except movie tickets, healthcare and education, will be costlier under the new tax regime. Insurance, banking, telephone and mobile services will be dearer by 3% as the tax has been hiked from 15% to 18%. Movie tickets will be cheaper due to 12% slash in the tax from 40% to 28%. Taxi rides and air travel (economy class) will be marginally cheaper in view of 1% tax cut. Air travel in business class will cost 3% more.

HOTEL BOOKINGS

Higher the bill the more tax consumers will pay. There will be no tax on hotel bookings costing less than Rs. 1,000, which earlier was 15%. For hotel bookings between Rs. 1,000 and Rs. 2,500, the tax has been brought down from 15% to 12%. Hotel bookings above Rs. 2,500 up to Rs. 5,000 will attract 3% more tax (18%). The tax on bookings in luxury hotels has been hiked by 13%, from 15% to 28%.

EATING OUT

You may pay more or less, depending on the type of restaurant you are moving in. Restaurants with turnover up to Rs. 50 lakh and those without air-conditioned facilities will pay less tax, but those with liquor licence will pay 2% more tax. Five-star hotels will attract 13% more tax, up from 15% to 28%.

CARS

Under the GST, diesel and mid-sized cars, including those running on petrol, will cost more, while SUVs and luxury cars will be slightly cheaper. The tax on small cars (diesel as well as petrol) has been hiked by 3%, and for mid-sized cars by 2%. The tax on luxury cars has been slashed by 2% (from 45% to 43%), and for SUVs by 5%, from 48% to 43%.