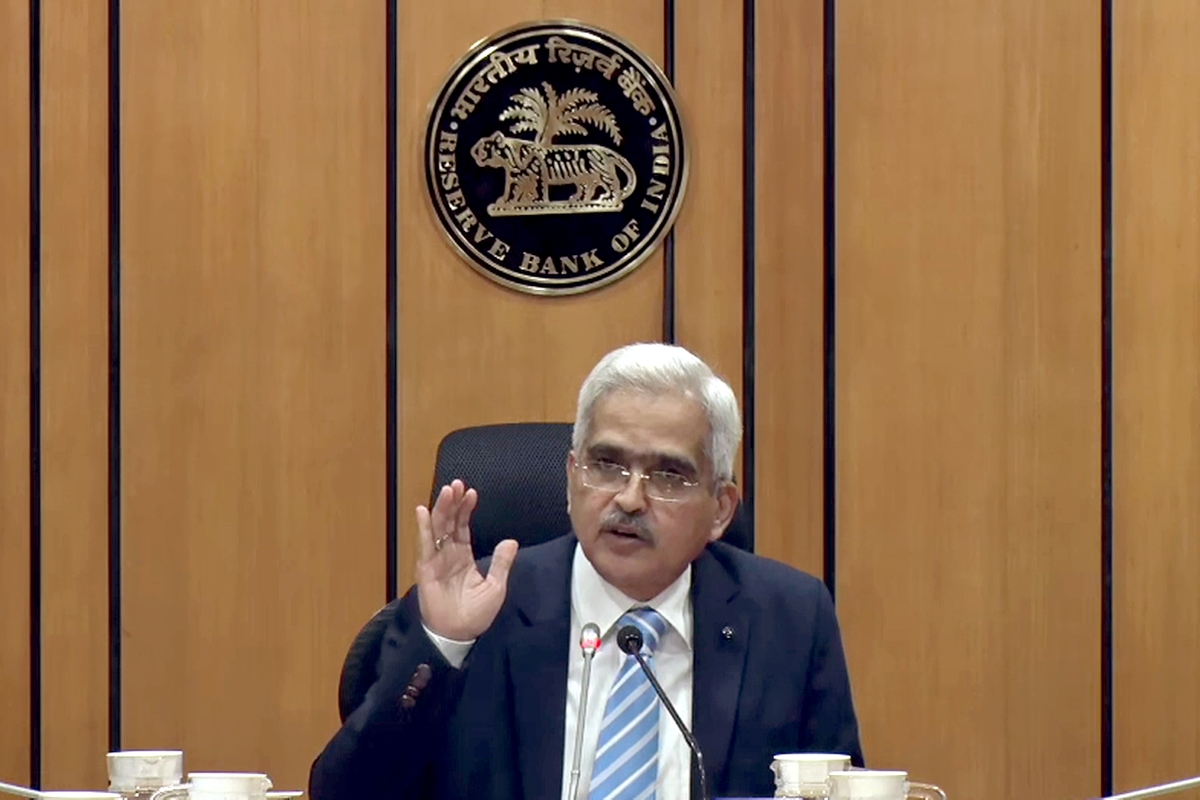

While retaining the GDP projection for FY 2021-22 at 9.5 per cent, RBI governor Shaktikanta Das asserted that the country was in a much better place relative to the last MPC meeting, adding that the policy rate decision was unanimous while the decision on stance was 5:1.

Das said, “India is in a much better place today than at the time of the last MPC meeting. Growth impulses are strengthening, inflation trajectory more favourable than expected.”

Advertisement

“The projection for real Gross Domestic Product (GDP) growth is retained at 9.5 per cent for FY 2021-22. This consists of 7.9 per cent in the second quarter, 6.8 per cent in the third quarter and 6.1 per cent in the fourth quarter of 2021-22,” Das said.

Notably, the Consumer Price Index (CPI) inflation for the first quarter of the financial year (FY) 2022-23 has been projected at 5.2 per cent.

“High-frequency indicators suggest economic activity has gained momentum. Core inflation remains sticky. July-September Consumer price Index (CPI) inflation was lower than anticipated,” the RBI Governor added.

Further, he added that the pent-up demand, the festival season should boost urban demand.

Amid the rising fuel prices, retail inflation stood at 5.3 per cent in August.

“Recovery in demand gathered pace in August-September. Pick-up in import of capital goods point to some recovery in activity,” Das said while hoping to sail towards normal times, due to resilience of economic fundamentals of the Indian economy.

Das further said, “RBI’s approach is that of gradualism, don’t want suddenness or surprises.”

The RBI has kept the repo rate, reverse repo rate unchanged at 4 per cent and 3.5 per cent respectively with an accommodative policy stance for ‘as long as necessary to revive and sustain growth on a durable basis’.

“The MPC has been given the mandate to maintain annual inflation at 4 per cent until March 31, 2026, with an upper tolerance of 6 per cent and a lower tolerance of 2 per cent,” he said.