Former RBI Governor appointed Principal Secretary-II to PM

Dr P K Mishra is the Principal Secretary-I to the Prime Minister.

The governor said, rather than becoming averse to lending, banks have to improve their risk management and governance frameworks, and also build sufficient resilience.

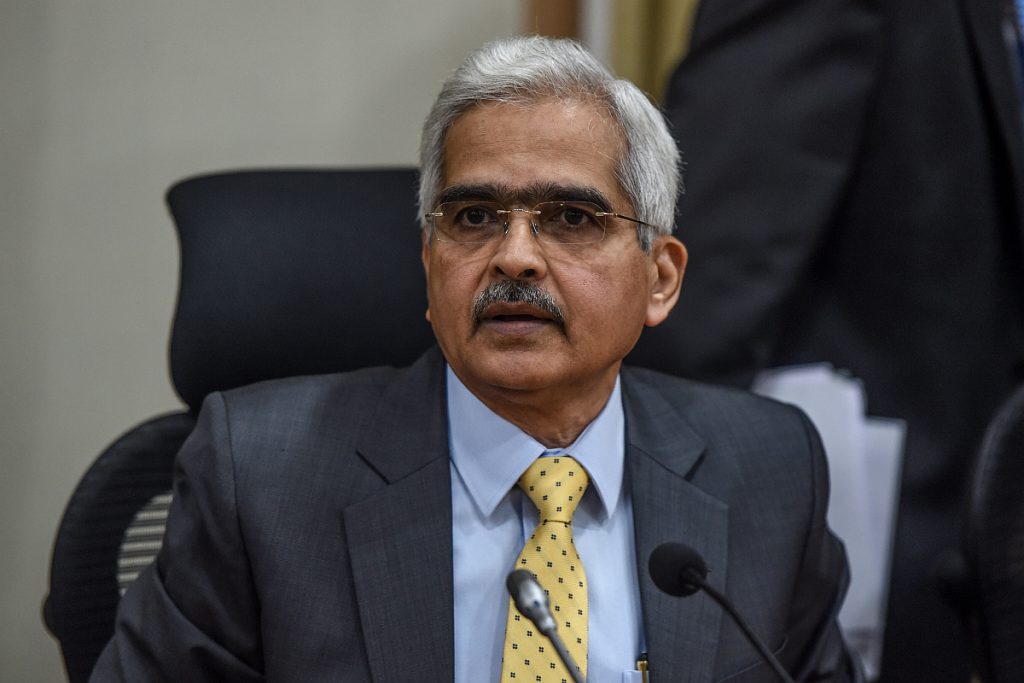

(File photo: AFP)

The Governor of Reserve Bank of India Shaktikanta Das on Thursday warned banks saying that extreme risk aversion can be self-defeating.

Das made the comment while he was delivering a keynote at a webinar organised by financial daily Business Standard. He cautioned that such an approach will affect their income.

Advertisement

The governor said, rather than becoming averse to lending, banks have to improve their risk management and governance frameworks, and also build sufficient resilience.

Advertisement

“While introspecting on newer ideas to improve the health of banks and quality of banking it is fundamental to reform the culture of governance and risk management. These two areas lent inherent strength to businesses of banking and a good amount of work has already been done in this direction,” he said adding that the central bank had recently uploaded a discussion paper on governance in commercial banks and currently the RBI was going to consider all the comments received.

Soon a final document on governance in commercial banks will be released.

Bankers point out to past experiences and feel that containing loans from getting sour is an important objective.

Das said there is a scope for banks to improve their ability to averts from happening and added that their risk frameworks should be able to smell vulnerabilities.

“One visible area of concern in the arena of risk management is the inability or the ability to manage the incidents of frauds, both cyber related and otherwise. The higher incidents of frauds which have come to light in the recent times have their origins in not so efficient management the capacity of the concern banks, both at the time of sanctioning of loans as well as in post sanctions monetary. There is considerable room for improvements in these areas,” Das said.

The Governor said, overall, the banking system continues to be sound and stable and the lenders will have to evolve a new model of growth in the times to come.

He said the RBI will withdraw its COVID-19 pandemic-related dispensations in a calibrated manner, but will not do so very soon.

Appreciating the work done by the government in response to the crisis, Das termed it as fiscally responsible, prudent and well calibrated.

Advertisement