Market Reality

India's equity markets, long buoyed by strong economic growth and rising corporate earnings, are now facing a sharp and prolonged correction.

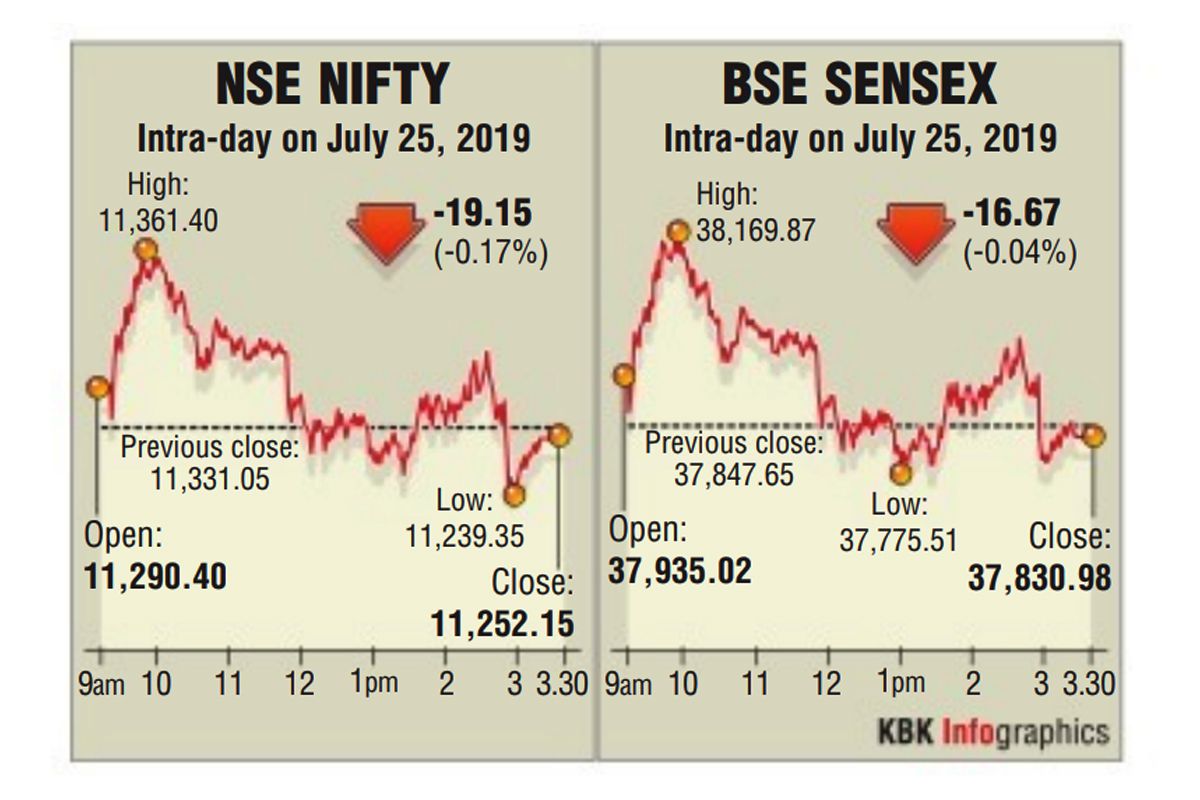

Sensex and Nifty that were up 38,169.87 (+322.22) points and 11,361.40 (+90.19) points gave away their intra-day gains to slip into red terrain in mid-session but again regained upside momentum in line with key Asian markets.

(Photo: sns)

Expiry of futures and options or F&O derivatives series for July was marked by volatile trade in equities in Dalal Street on the last Thursday of the month.

In morning deals , the 30-share Sensitive Index of Bombay Stock Exchange and 50-scrip Nifty of National Stock Exchange surged on strong short covering by traders but the rally could not be sustained as the two benchmarks lost steam by the afternoon.

Advertisement

Sensex and Nifty that were up 38,169.87 (+322.22) points and 11,361.40 (+90.19) points gave away their intra-day gains to slip into red terrain in mid-session but again regained upside momentum in line with key Asian markets.

Advertisement

After up and down swings, the benchmarks closed flat just below the flatline.

Another reason for initial bullish rise in indices was a Reuters opinion poll that overwhelmingly — about 80 per cent of the participants — indicated that the Reserve Bank of India is “all set” to lower its short-term lending rates or repo rate to banks by 25 basis points or 0.25 per cent. RBI’s monetary policy committee will announce its next bi-monthly credit policy on 7 August.

The Governor has also hinted that MPC’s “accommodative” stance would continue as the central bank is committed to support the government’s steps to facilitate economic growth.

Apart from rate cut, market participants are also interested to know the details of the Bimal Jalan panel’s recommendations on the quantum of cash that could be transferred to the government coffers. Dalal Street buzz suggests the panel appears to be in favour of such transfer.

Dr Jalan, a former RBI Governor, has also spoken in favour of the government’s move to raise $10 billion via issuance of external sovereign bonds of long duration.

He said, “At the moment we are in a fortunate position… our debt to GDP ratio is not very high so foreign borrowing, if it is in long-term, which it would be, is not a problem; besides India’s foreign exchange reserves also are high.”

Markets expect a big announcement by the MPC at its 7 August media briefing. Analysts say it would ease the pressure of higher fiscal deficit in FY 2019-20 as the government is exploring all options to raise revenue since the economy for the last four years is purely driven by the government’s capex or capital expenditure in the absence of a supportive private capex by India Inc. and others.

Analysts say this is one major reason that drove the government to sell 30-year tenure bonds to raise $10 billion this fiscal. Market sources claim the government has been in talks with offshore banks and is believed to have received a positive response. Market also expect RBI-MPC’s response to latest International Monetary Fund’s move to lower India’s GDP for the year to 7 per cent from 7.30 per cent.

The coming credit policy could serve as a positive trigger for equity market as the RBI Governor has again nudged the lenders to pass on benefit of its three repo rate cuts to their customers which economists say is essential for credit growth and pick-up in consumption. The worst for the market could be over.

There has been a reasonable correction in the past two months, said IDBI Capital’s AK Prabhakar. But an authoritative comment came from Aditya Puri, MD of the biggest private lender HDFC Bank, who told a business website that he felt the doom was over and “we can only move up from here”.

No need for pessimism despite economic slump. There are some good things that are happening such as transformation wrought by digital revolution although HDFC Bank had raised concern over demand in some segments.

Puri has backed the government move to mop up $10 billion via external debt instruments saying, “I would say it is imperative we bring money into the system and use it to spend it for productive purpose.”

He also pointed out that IT surcharge was a move to spread the tax base although the move seems tentative. Bajaj Finance numbers for Q1 (April-June) did not disappoint market participants today as the best performing NBFC declared 43 per cent rise in net profit to Rs 1,195 crore vs Rs 836 crore a year ago.

Analysts say the jump has been mainly on account of rise in AUM or assets under management for the quarter to Rs 1,28,898 crore, a rise of 45 per cent. That also raised loans booked for FY 20 to 7.27 million an increase of 29 per cent.

However, Bajaj Finance declared marginal rise in its gross and net NPAs to 1.60 per cent and 0.64 per cent from 1.54 per cent and 0.62 per cent in previous quarter ended 31 March 2019. The provision to cover bad loans was up to Rs 551 crore which is alarming 69 per cent up. This resulted in stock hammering by speculators. Bajaj Finance share took a hit on that account.

The volatile session ended with Sensex closing 37,830.98 (-16.67) points, a fall of 0.04 per cent with 16 stocks in green and 14 in red. Nifty at 11,252.15(- 19.15) points was 0.17 per cent down as 22 shares moved up 27 down and one unchanged.

Nifty Bank settled at 29,043.05 (+90.80) points rising 0.31 per cent. Gainers in BSE benchmark included Sun Pharma Rs 436.45, 2.53 per cent; IndusInd Bank Rs 1,394.00, 2.39 per cent; and Axis Bank Rs 724.75, 1.92 per cent. Bajaj Finance ended 4.23 per cent down at Rs 3,038.00.

Advertisement