Market Reality

India's equity markets, long buoyed by strong economic growth and rising corporate earnings, are now facing a sharp and prolonged correction.

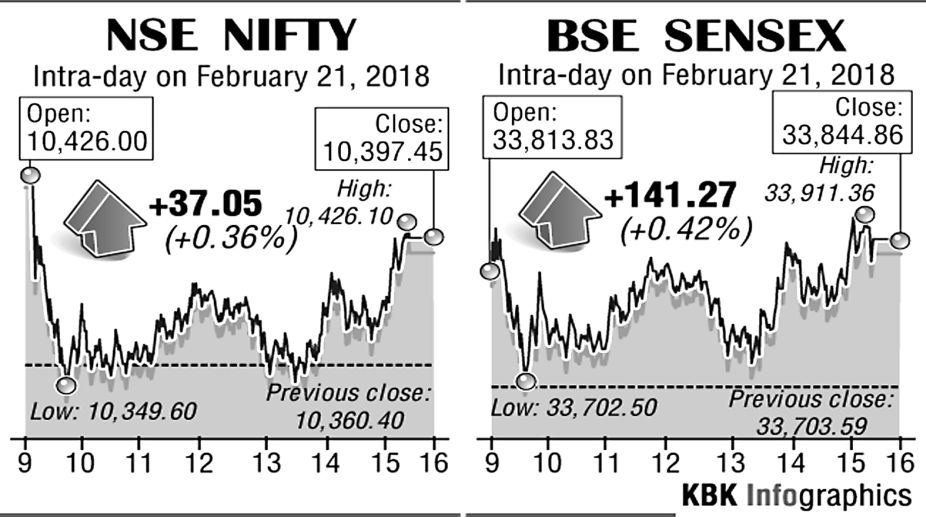

Stock Market Intraday.

After three straight sessions of loss, the equity benchmarks of Bombay Stock Exchange and National Stock Exchange returned to green zone in a rally, led by information technology shares and FMCG shares such as ITC.

Significantly, the 30-share Sensitive Index of Bombay Stock Exchange and the 50-scrip Nifty of National Stock Exchange retained their upside momentum as they edged ahead bringing relief to bear-hammered Dalal Street.

Advertisement

Since its record high of 36,443 points in January, the Sensex slipped seven per cent and so did the Nifty that had surged to a record high of 11,172 points. As the day progressed, the main indices stayed on course retaining their gains. Apart from domestic sentiment that is gradually improving, analysts cited gains in Asia-Pacific markets for improvement in sentiment.

Advertisement

An opinion poll of market players and brokerages by a leading business channel suggests the market conditions are steady enough to pick up quality shares that have withstood the massive sell-off triggered by$1.88-billion Punjab National Bank’s fake letter of undertaking fraud.

However, state-run bank stocks also staged a comeback on short-covering as analysts see the PNB fraud will soon be factored in by the market with domestic investors resuming liquidity flows into equity.

The Sensex closed for the day 0.42 per cent or 141.27 points up at 33,844.86 points. The Nifty gained 0.36 per cent or 37.05 points to end at 10,397.45. The Nifty Bank gained 0.25 per cent or 62.30 points to end at 24,936.70 points. The Nifty PSU Bank made a comeback increasing by 0.57 per cent or 34.15 points to 3,170.70 points. In the Sensex pack, 17 stocks moved up and 14 were down. For the Nifty, the advance-decline ratio stood at 29 versus 21.

Nevertheless, domestic headwinds and dicey global cues are likely to keep all markets edgy with spells of profit booking as indices move forward, say pollsters.

Mr Mark Mobius of Templeton’s Emerging Market Group told the channel: “We will be watching India on policy front and policy reforms that Prime Minister Narendra Modi is implementing and has implemented. If there is any pullback or any step backward, that would be a bad news.”

Domestic agency Sharekhan says: “We at Sharekhan do not have short-term target for market indices. We believe earnings will pick up in FY 2019 that could support market going ahead.”

Market participants are, however, sanguine of the Sensex and the Nifty regaining their 36,000 and 11,000 levels by December. The market might have lost seven per cent since January, but the same indices have recorded an impressive 25 to 27 per cent jump since April 2017, point out analysts.

Amid reports of owner Mehul Choksi shutting down Gitanjali Gems, sellers crowded the counter to get rid of whatever holdings they still have.

The stock dipped another 10 per cent intra-day to lowest ever of Rs 27.45. Since the PNB fraud came to light, the share has cracked 56 per cent with no buyers in Dalal Street.

Market experts say Mr Choksi and his nephew Nirav Modi siphoned off loan money to allegedly buy assets abroad. Mr Choksi has refused to compensate his franchises that have reportedly placed crores of rupees in deposits with him. Nor has he agreed to pay salaries of his staff as both he and Mr Modi have told them to find new jobs elsewhere.

Advertisement