The 26th GST Council meeting held on Saturday decided that the e-way bill will be implemented from 1 April for inter-state movement of goods.

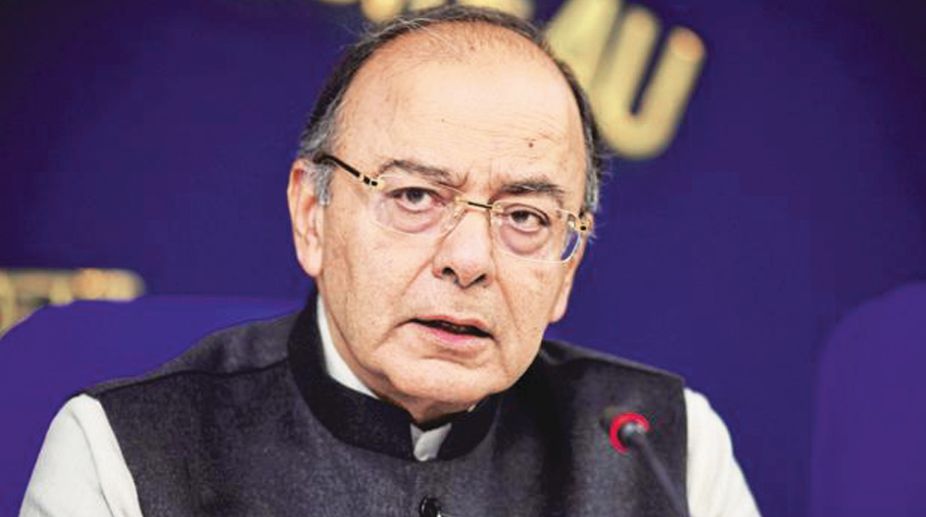

Briefing the media after the crucial GST Council meet, Union Finance Minister Arun Jaitley said, “Intra-state e-way bill will be rolled out in phased manner with four groups of states.

Each group will come under it every week after 1st April and efforts will be made to implement it across the country by April end.”

The inter-state e-way bill last December was approved for an early mandatory roll-out from 1 February but due to technical glitches, it was deferred.

E-way bill is an electronic bill required to be procured by transporters and traders under the GST regime for transportation of goods and services beyond a radius of 10 km.

An e-way bill needs to be generated and carried for movement of all goods valued at over Rs 50,000. In its 24 February meeting, a group of ministers headed by Bihar deputy chief minister Sushil Modi recommended 1 April as the date for compulsory implementation of the system for inter-state goods movement.

The tax exemption for exporters has been extended by six months and all pending claims of refunds of exporters are expected to be cleared by 31 March, Jaitley said.

The GST Council also decided to implement e-wallet scheme for giving refunds to exporters under GST by 1 October 2018. Accordingly, merchant exporters can pay a tax at the rate of 0.1 per cent on goods procured for export purposes and obtain a refund for the same.

The Council, however, failed to come up with a simplified system of filing returns and the existing system would continue for three more months for filing returns, Jaitley added.

Jaitley said the tax bureaucracy wanted a mechanism to file returns which would leave no room for tax evasion. The Council has discussed two alternate ways of return filing processes.

“The council had in mind that the system, in which the returns would be processed once a month, would be easy and there will not be any chances of evasion,” the Finance Minister said and added that the Council would form a Group of Ministers (GoM) to deliberate the matter and meet with information technology experts to come up with a solution.

The Council could not decide on a simplified GST return form and hence entrusted the ministerial panel under Sushil Modi to chalk out a single page form which is simpler and evasion proof.

The GST Council also extended the reverse charge mechanism and TDS and TCS provisions for three months or till 30 June. “The formalities which need to be finalised for the tax deducted at source (TDS) and tax collection at source (TCS) system, which involves linking of the accounting system of both the central and state government, has been extended until 30 June,” Jaitley said.

Advertisement