Trump announces US withdrawal from World Health Organisation

Trump has long been critical of the WHO, and his administration formally withdrew from the organisation in July 2020 as the Covid-19 pandemic continued to spread.

Even short-term closures will have significant financial implications.

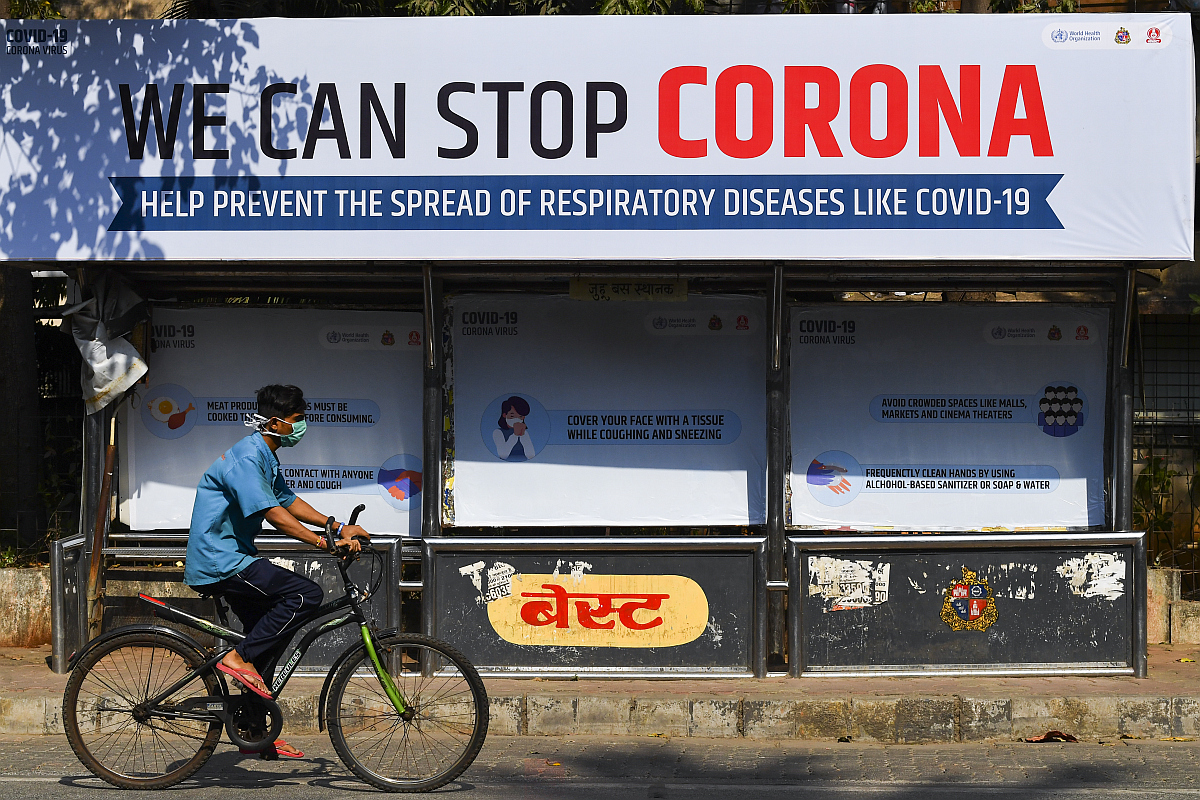

A man rides past by an awareness board displaying preventive measures against the COVID-19 coronavirus at a bus stop in Mumbai on March 16, 2020. (Photo: Indranil MUKHERJEE / AFP)

The rising fear around the deadly coronavirus (COVID-19) has created a panic across the country, forcing majority of state governments to shutdown malls and multiplexes to prevent people congregating for any reason. While the measures taken seem to be very necessary and timely, the decision will later have a severe financial impact on the country’s retail sector.

Anarock Retail’s MD & CEO, Anuj Kejriwal said, “wherever it has been mandated, there will, therefore, be a high number of establishments that need to shut down for operations. Even short-term closures will have significant financial implications.”

Advertisement

“However, what matters more is that these establishments attract massive footfalls. In a health crisis like the coronavirus pandemic, shutting them down can be a major step forward in terms of harm prevention,” Kejriwal, however, added.

Advertisement

According to Anarcok Retail data, Ahmedabad, Bangaluru, Chennai, Delhi/NCR, Hyderabad, Kolkata, Mumbai and Pune have 126 malls sprawling over more than 61 million sq. ft. area, and more than 100 malls have multiplexes attached.

Of the total numbers, Delhi-NCR region comprises 33 malls out of which 18 malls have movie theatres attached. Along with these, schools and colleges, have also been shutdown till March 31.

(With input from agencies)

Advertisement