RBI asks fintech firms, digital payment cos to ensure responsible innovation

RBI Governor Sanjay Malhotra on Thursday asked fintech firms and digital payment companies to ensure responsible innovation and better compliance.

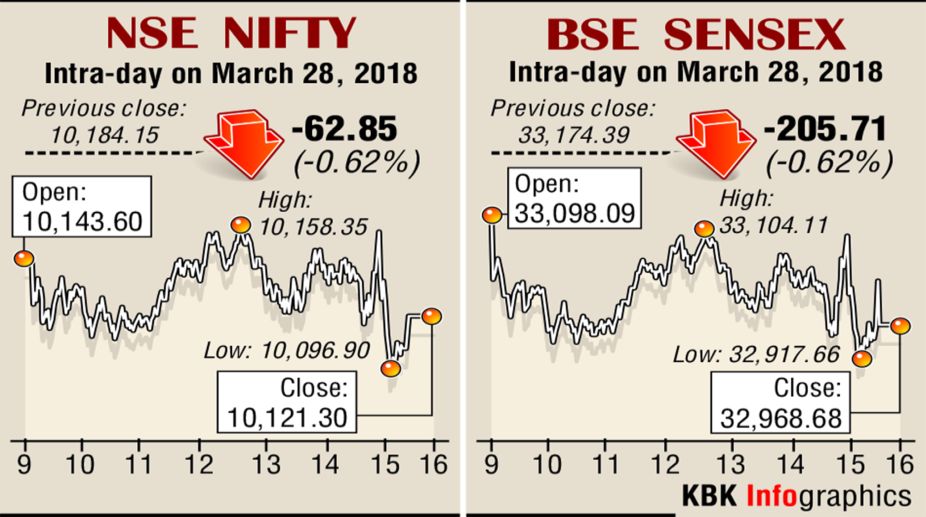

Stock Market Intraday. (SNS)

As the banking sector faces huge losses on account of myriad frauds discovered by their internal mechanism in the last three months, their stocks took a hit in the last session of the financial year 2017-18 in Dalal Street on Wednesday.

Private and state-run lenders gave away gains of the previous two sessions amid fresh selling pressure by market participants who were informed by IDBI Bank that it too has discovered a R 750 crore embezzlement of its funds in five branches in Andhra and Telangana.

Advertisement

Weakness in market was also on account on volatility caused by the expiry of F&O derivatives for March. Whatever significant rollover will pass on to new fiscal 2018-19, say, analysts.

Advertisement

The 30-share Sensitive Index o Bombay Stock Exchange and 50-scrip Nifty of National Stock Exchange opened weak in line with overnight negative end to Wall Street and its spread to Asia-Pacific exchanges in the early morning.

Market players apparently avoided risk ahead of a big weekend as they now look forward to a better 2018-19 fiscal starting Monday. On Wednesday, after market hours, the government is to declare its fiscal deficit estimate.

Analysts say fear of deficit target overshooting budgetary estimate also dampened the market on Wednesday although the government had given a clear hint that in the first half of the new financial year it would restrict its borrowing to 44 per cent against the average of 60 per cent or more in the last two years.

In the first week of the new fiscal, Reserve Bank of India-Monetary Policy Committee or MPC will make its bi-monthly policy statement on 5 April. Market surveys say the central bank is expected to tone down its hawkish tone of previous statement in view of moderation in vegetable and other farm produce prices due to richer harvest.

The consumer price index inflation or CPI that dropped to 4.44 per cent in February is likely to drop further which reduced the chance of RBI raising its policy repo or repurchasing rate as was being feared a fortnight ago.

RBI may also revise its inflation projection for next fiscal. For the first half –April to September — it has projected CPI between 5.1 per cent to 5.6 per cent.

Moreover, the sudden spike in GDP growth in October-December quarter to 7.2 per cent also came as a big surprise to analysts who now expect RBI to make suitable changes in its outlook in the near-term.

The benchmarks might have corrected by nearly 10 per cent giving away the record gains of 2017 calendar year (Sensex peaked 36,443.98 points and Nifty 11,171.55 points as on 29 January) but the primary market ended with the strongest ever performance in a decade.

According to PRIME Database, 43 companies raised over Rs 805 billion or more than 80,0000 crore that was the biggest haul since 2008 when 81 companies netted Rs 413 billion. Even 2016-17 was a tame IPO year when 25 companies raised Rs 282 billion.

The main reason for strong IPO collection was a robust secondary market which was flush with liquidity as mutual funds and other domestic institutional investors poured household savings into equity market regardless of stretched valuations that kept their foreign counterparts or FPIs on guard.

This month as on Tuesday, FPIs were net investors of Rs 12,278.48 crore in shares while DIIs were net buyers of Rs 4,958. 29 crore.

The Sensex of BSE closed 32,968.68 (-205.71) points down 0.62 per cent while Nifty of NSE declined 0.69 per cent to end 10,113.70 (-70.45) points.

Bank shares dropped on day-long hammering. Dalal Street buzz suggests Reserve Bank of India has in principle agreed to permit Punjab National Bank to spread its losses due to fake letters of undertaking fraud over the next four quarters.

The Delhi-based PSB had asked RBI to grant it permission to adjust its accounts accordingly. Nifty Bank and Nifty PSU Bank slipped 0.70 per cent and 1.93 per cent to settle at 24,263.35 (-170.80) points and 2,878.50 (-56.50) points. In Sensex 12 shares advanced and 19 declined. For Nifty the ratio was 20:30 .

Losers in BSE benchmark included Tata Steel Rs 571, -3.33 per cent; Bharti Airtel Rs 399, -3.03 per cent; RIL Rs 881.85, -2 per cent; and ICICI Bank Rs 278.90, -1.76 per cent.

Advertisement