Can technology hamper kids’ early communication skills?

Are you a tech buff and have filled your house with latest technologies from Amazon's Alexa and Apple's Siri to the Google Assistant?

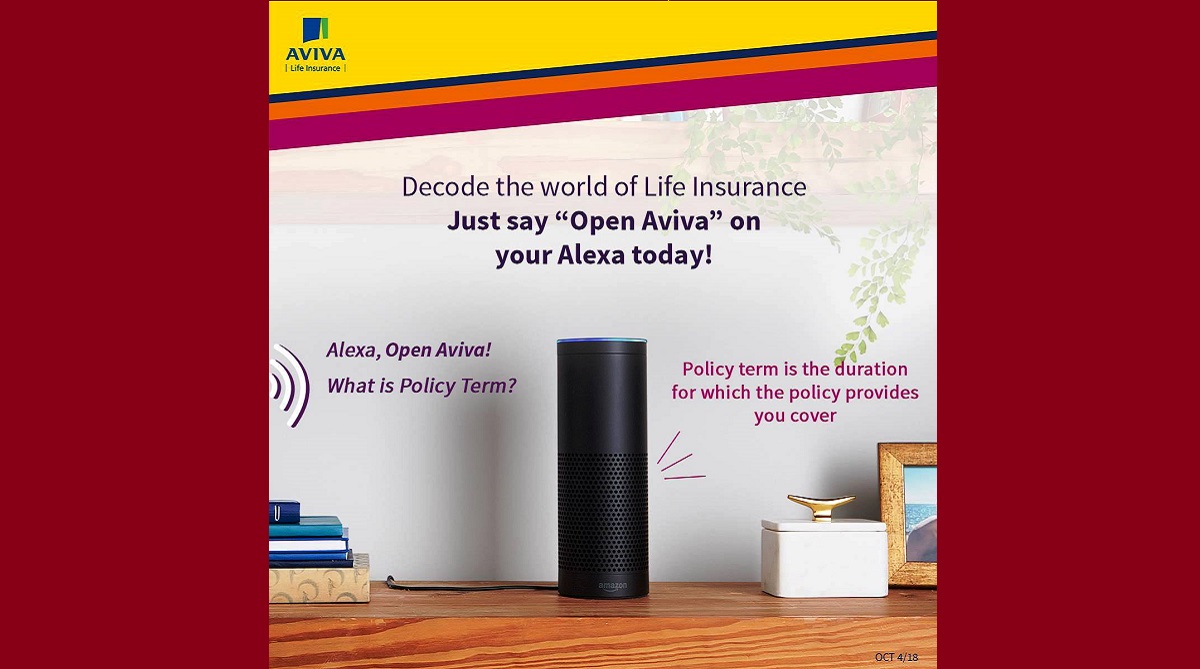

Aviva has launched the Insurance Made Simple, a skill within Alexa’s skill set that enables customers to understand the various complex terms in insurance through the latest digital innovation.

Aviva has launched Insurance Made Simple. (Photo: Twitter/@AvivaIndia)

Aviva Life Insurance on Wednesday announced its debut on Amazon’s Alexa platform with Insurance Made Easy. With this new digital initiative, Aviva becomes the first life insurance company in India to offer an Alexa skill to engage with its customers to simplify life insurance jargon. With Alexa, the company aims to promote financial literacy amongst its existing and potential customers across all ages and geographies. This is an initiative basis the Aviva Plan India Plan survey conducted in 2017, which clearly indicated that though Indian’s are big dreamers when it comes to financial planning they lag behind by a considerable distance. One of the key reasons for this is that people get intimidated by complex insurance jargon and are unable to take the right decision in terms of financial planning.

To help bridge this gap and to increase financial literacy in India, Aviva has launched the Insurance Made Simple, a skill within Alexa’s skill set that enables customers to understand the various complex terms in insurance through the latest digital innovation around us: voice-enabled commands. For instance, customers can launch Aviva on the Alexa Device by using the invocation phrase Alexa, open/launch Aviva, and can ask questions like “What is Term Insurance,” “What is Surrender Benefit,” and Alexa will immediately reply to the command addressing such questions. The objective is to equip the user with a clear understanding of the complex terms used in life insurance by using simple, easy to understand language.

Advertisement

Commenting on this development, Anjali Malhotra, Chief Customer, Marketing, and Digital Officer, Aviva Life Insurance said, “At Aviva, we are guided by our principles of Digital First and Innovation, as well as our core purpose of increasing financial literacy in India. The Insurance world is fairly complex and demystifying life insurance for our customers will enable them to make informed decisions for themselves and their families. Our aim is to make insurance simple for all, by busting insurance jargon, thereby enabling consumer adoption and thus larger penetration of protection in the country.

Advertisement

Advertisement