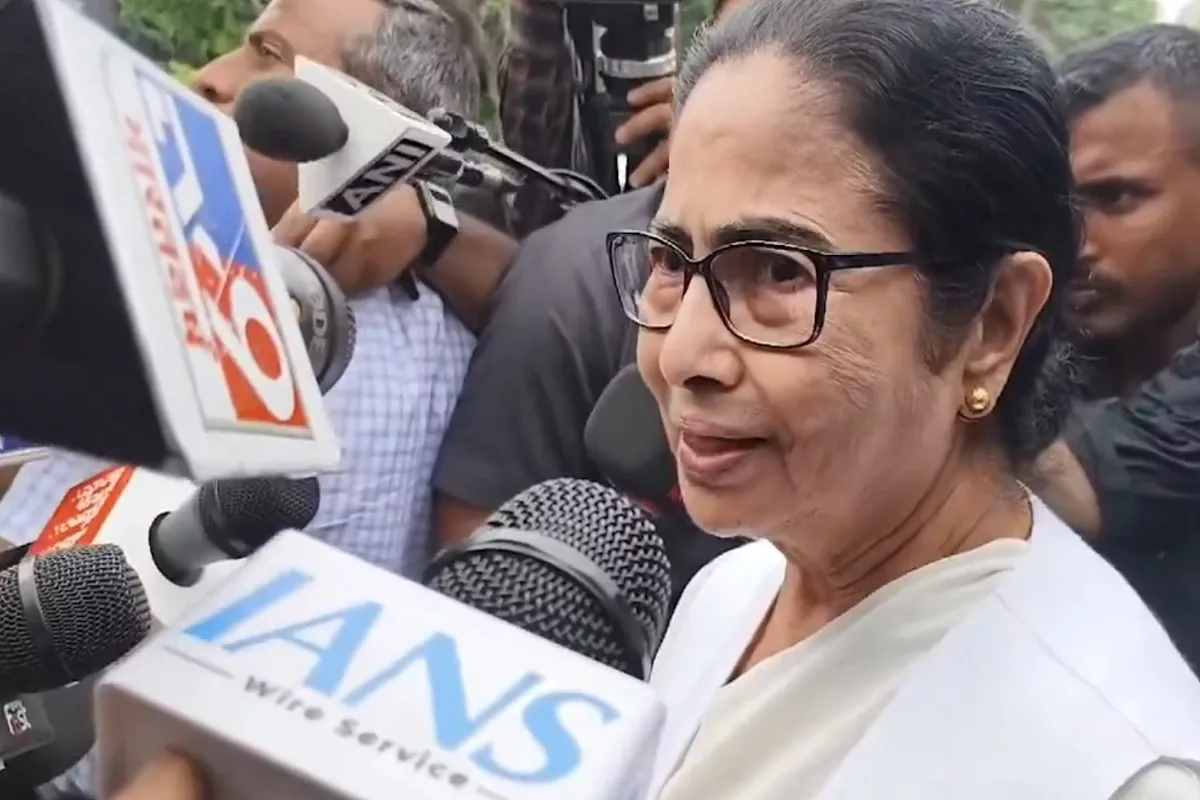

Chief Minister Mamata Banerjee today wrote to Union Finance Minister Nirmala Sitharaman to withdraw the 18 per cent GST on life and health insurance policies and to allow deductions in the new tax regime under section 80C and 80D of the Income Tax Act. Miss Banerjee wrote: “The primary purpose of life and health insurance is to provide financial security and support during unexpected times such as illness, accidents and untimely deaths. These policies play a crucial role in ensuring that the individuals and their families are able to cope with the financial hardships during such challenging times.”

She maintained that the imposition of GST on insurance premium increases the financial burden on common people. This additional burden may be acting as deterrent for many individuals from taking new policies or continuing their existing insurance coverage, thereby leaving them vulnerable to unforeseen financial distress. Moreover, insurance services as a vital component of the social safety net, reducing the government’s burden in providing direct financial assistance to citizens during such emergency, Miss Banerjee wrote. She further wrote: “We all know that health is wealth. Healthcare is a major social security and it is our commitment to extend to the common people maximum social security in this area to ensure their good health and well being. Health and life insurance cover is now available to all sections of society, including farmers and daily labourers. Thus, it is quite obvious that imposing burden of GST in health and life insurance will put the common people under greater stress and anxiety, and deprive them of the benefit of social security net. We must at any cost avoid it.”

Advertisement

She remarked that adding to the common people’s woes is the withdrawal of incentives that were available under the Income Tax Act in the old tax regime. She wrote: “In light of the above consideration, I request you to kindly review the antipeople taxation policies and withdraw the GST on life insurance and health insurance premiums; and include deduction under sections 80C and 80D of the Income Tax Act on such premium in the new tax regime. In fact, this will facilitate wider insurance coverage for the common people with more mental and financial stability.”