Market posted strong gains, most of Adani Group stocks recover

At close, the Sensex was up 1,961.32 points or 2.54% at 79,117.11, and the Nifty was up 557.35 points or 2.39% at 23,907.25.

The Diwali week continued bringing good tidings for investors and Dalal Street even after ‘Muhurat’ trading on Sunday the 12th of November.

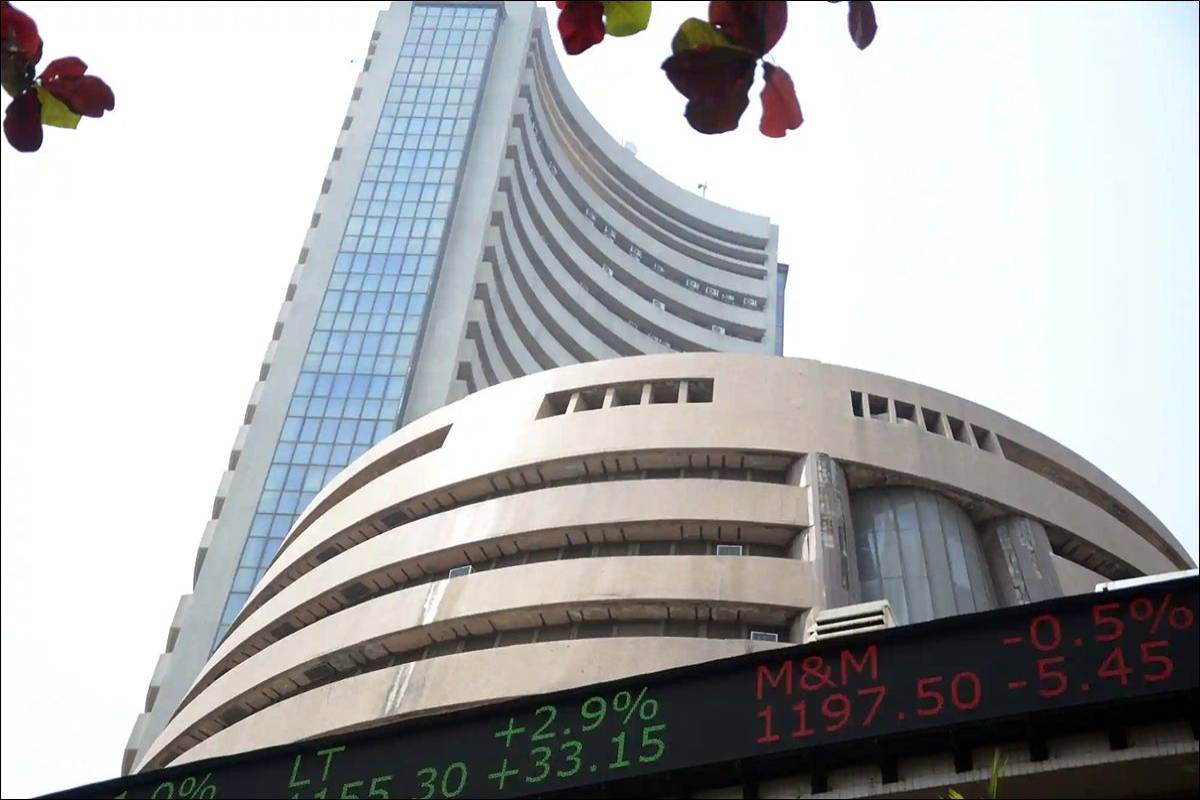

(File Photo)

The Diwali week continued bringing good tidings for investors and Dalal Street even after ‘Muhurat’ trading on Sunday the 12th of November. The week saw gains on two of the four trading sessions but the weekly gains were much bigger than what two day of gains and two days of losses would indicate. The moot point of discussion now would be how much more and how long. We will try to attempt to answer this later in the article but it would only be in part as the subject is too complex.

The week ended with BSESENSEX gaining 890.05 points or 1.37 per cent to close at 65,794.73 points, while NIFTY gained 306.45 points or 1.58 per cent to close at 19,731.80 points. The broader markets saw BSE100, BSE200 and BSE500 gain 1.65 per cent, 1.84 per cent and 1.96 per cent respectively. BSEMIDCAP gained 2.5 per cent while BSESMALLCAP was up 3.18 per cent.

The Indian Rupee recovered 7 paisa or 0.08 per cent to close at Rs 83.27 to the US Dollar. Dow Jones had yet another stellar week and gained on four of the five trading sessions. It lost on just one session. Dow Jones gained 664.18 points or 1.94 per cent to close at 34,947.28 points.

Advertisement

Markets are at some sort of crossroads currently. They are being powered by the midcap and Smallcap space which seems irrational and also leads one to believe that at some point this would lead to over exuberance. On a Samvat-to-Samvat basis, the out performance was more than three times, something which has to stop and correct at some point of time. Currently the two heaviest of stocks in the benchmark indices, Reliance Industries and HDFC Bank seem as if they are in hibernation. Further the IT pack which saw some sort of recovery last week still seems to be under pressure. To add to the woes of the benchmark indices, RBI raised the risk-weight from 100 per cent to 125 per cent on consumer credit. This will make an impact on cost of funds in the short term and impact general cost of borrowing for the entire banking industry in the medium term. While the measure is welcome as questions were raised about consumer credit and impact on some of them turning delinquent. This move will impact banking industry performance in the short to medium term. Bank NIFTY was one sore point in the rally last week.

Suffice to say that there would be pressure on the benchmark indices in the immediate short term with so many non-performing stocks. To expect this to be replaced by movement by midcap and Smallcap stocks would be out of place. Expect therefore that there could be a sideways movement for some time. Impact of results of five state assemblies to be declared on 3rd December would have a knee jerk reaction at best.

We have five primary market issues opening and closing in the next five days. While the first would open on Tuesday and close on Thursday, the remaining four would open on Wednesday and close on Friday. This would affect the liquidity in the market for a week as people look to apply for these issues.

The first issue is from Indian Renewable Energy Development Agency Limited, a PSU enterprise which is tapping the markets with its fresh issue for 40.31 crore shares and an offer for sale of 26.87 crore shares in a price band of Rs 30-32. The issue opens on Tuesday the 21st of November and closes on Thursday the 23rd of November. The company as the name suggests is the nodal agency for Renewable energy and has financed multiple projects from the full value chain. Its AUM is Rs 47,500 crore as of 30th September 23. The company has GNPA of 3.21 per cent and NNPA of 1.66 per cent. The shares are being offered at a price to book of 1.15-1.23. The EPS for the year ended March 23 is Rs 3.78. The PE for the company is 7.94-8.47. The company compares favourably with PFC and REC. Investment makes sense in the company and it offers scope for appreciation in the short and medium term.

The second issue is from Tata Technologies Limited which is tapping the capital markets with its secondary offer of 6.08 crore shares in a price band of Rs 475-500. The issue would open on Wednesday the 22nd of November and close on Friday the 24th of November. This being an entirely offer for sale, there is no object of issue. The company derives revenues from its services business and automobile business engineering. It has now been approved for the aerospace business vertical and is now working very closely with Airbus. Revenues from the aerospace industry would be visible from the financial year 2024. The company is a leading player in the EV segment and has helped many companies globally to launch EV, re-engineer ICE to EV and also assist in the role of EV as the way forward. The company reported revenues of Rs 4,414 crore for the year ended March 23 and Rs 2,526 crore for the six months ended September 23. It has a PAT margin of 14.14 per cent. The EPS for March 23 was Rs 15.37. The PE multiple at the price band is 30.90-32.53. The issue is attractively priced, offers scope for appreciation in the short to medium term. The size of the issue is relatively small at just about Rs 3,000 crore. The hype about the issue, will leave many investors dissatisfied about the non-allotment. In any case an investment which must be made.

The third issue to tap the market is from writing instruments maker, Flair Writing Industries Limited which is tapping the capital markets with its fresh issue of Rs 292 crore and an offer for sale of 301 crore in a price band of Rs 288-304. The issue would open on Wednesday the 22nd of November and close on Friday the 24th of November. The company makes writing instruments and is a market leader, having brands such as Flair, Hauser and Pierre Cardin. It reported revenues of Rs 942 crore for the year ended March 23. It is also in the business of consumer homeware and makes plastic products. Its closest competitor would be recently listed Cello World who has the plastic business as its dominant business and the writing instruments as accounting for about 15 per cent. Here the case is the opposite where the dominant business is writing instruments. The company enjoys best in class net margins which are just short of double digit. The company reported an EPS of Rs 12.66. Based on this EPS, the PE multiple is 22.75-24.01 for the issue. Looking at the success of Cello World and the similarity in business, the issue would do well and offer scope for appreciation in the short to medium term. Yet another investment that is justified.

The fourth issue to tap the markets is Gandhar Oil Refinery (India) Limited which is tapping the capital markets with its issue in a price band of Rs 160-169. The issue consists of a fresh issue component of Rs 302 crore and an offer for sale of 1.17 cr shares. The issue would open on Wednesday the 22nd of November and close on Friday the 24th of November. The company is the largest producer of white oils in the country and reported revenues of over Rs 4,000 crore for the year ended March 23. The company supplies its products to companies in the personal care, healthcare industry and performance oils. It has its plants in Maharashtra, and Sharjah in UAE. The company reported an EPS of Rs 23.77 for the year ended March 23. Based on this EPS, the PE for the issue is 6.73-7.11. The PE is indeed attractive and offers scope for appreciation in the short to medium term. The company would grow in the segments where it is a significant player and better utilising its Sharjah capacity which is a new plant and yet to reach full utilisation. Further the objects of the issue include capacity expansion which would lay the roadmap for further growth as the Maharashtra plant capacity is close to being fully utilised at 95 per cent.

The fifth and final issue is from Fedbank Financial Services Limited which is tapping the markets with its fresh issue for Rs 600 crore and an offer for sale of 3.51 crore shares in a price band of Rs 133-140. The issue would open on Wednesday the 22nd of November and close on Friday the 24th of November. The company is an NBFC and is focussed on the MSME segment. They cater to the MSME and the emerging self-employed individuals. They provide business loans, gold loans and housing loans whether through mortgage or loan against property. The NBFC is promoted by Federal Bank and has True North as a strategic PE Investor who invested in the company some five years ago.

The company reported an EPS of Rs 5.59 for the year ended March 23. The PE for the share based on these earnings is 23.79-25.04. The NAV of the NBFC is Rs 42.11 prior to the issue. Based on this the price to book is 3.32. The valuation looks a tad expensive and this would get accentuated as the BFSI space continues to reel under selling pressure on account of the risk weightage that RBI has changed for consumer loans. While FedFina as the NBFC is popularly known is not affected as it is not present in the segment, the sentiment would get affected. The valuations in light of the new developments make the bank that much more expensive and considering the choice of four other issues on similar dates, make this a least preferred option. The issue may be looked at if funds are available or may be on listing.

The market has five issues opening and closing between Tuesday the 21st of November and Friday the 24th of November. The amount to be raised would cumulatively be about Rs 7,400 crore, a fairly decent sum. This would put pressure on individual investors to allocate scare resources. Each individual needs to allocate resources based on likely subscription and hence allotment and then likely profits. For example, the buzz for Tata Technologies is the highest and would garner the largest subscription, implying the toughest allocation. Similarly, as mentioned and explained earlier, FedFina may have a tepid response in comparison to Tata Technologies. In short do some homework in allocating your resources for these five issues.

Coming to the markets in the coming week, expect sideways movement with some wild intraday swings. Not much change on a weekly basis should be expected. A major move upwards would happen when participation in the benchmark indices from heavyweight laggards begins to happen. Till then trade cautiously.

(Arun Kejriwal is the founder of Kejriwal Research and Investment Services. The views expressed are personal)

Advertisement