Samsung top pick for retail investors after US election

Retail investors scooped up 2.33 trillion won ($1.67 billion) worth of Samsung Electronics stocks since the U.S. presidential election, the country's main bourse said on Sunday.

Washington’s Chips Act and its requirements for companies receiving incentives are likely to put South Korean chipmakers’ ability to navigate business uncertainties and balance between the US and China to the test.

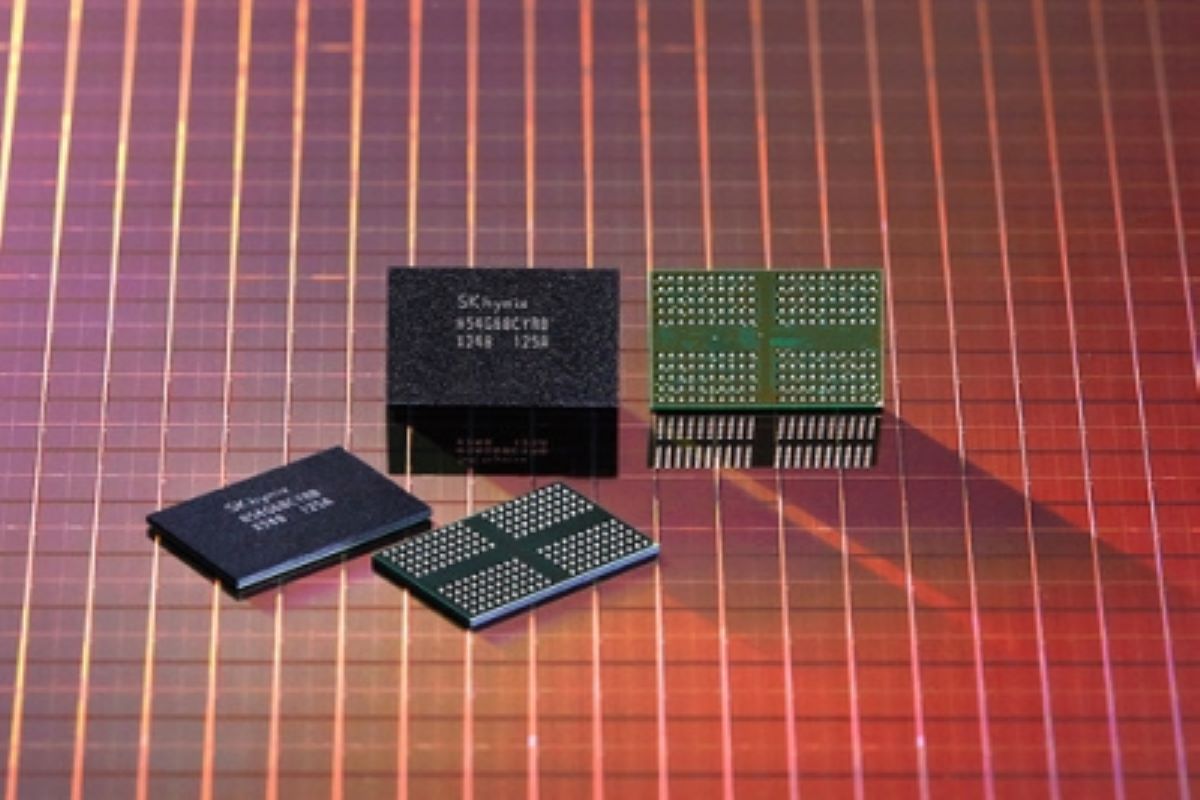

[Photo:IANS]

Washington’s Chips Act and its requirements for companies receiving incentives are likely to put South Korean chipmakers’ ability to navigate business uncertainties and balance between the US and China to the test.

The Biden administration has announced conditions for subsidies under the $53 billion act, designed to revitalise the American chip industry, secure supply chains and keep China’s technology advances in check.

Washington reaffirmed that it will not tolerate any recipient of the federal money expanding their semiconductor business in China and potentially helping one of the largest chip markets get easier access to advanced chip technology, reports Yonhap news agency.

Advertisement

“First and foremost, the Chips and Science Act is about national security … Manufacturing more chips here at home will help secure our national security future for decades to come,” Commerce Secretary Gina Raimondo wrote on Twitter.

The act requires “successful applicants to enter into an agreement not to engage in any significant transaction involving the material expansion of semiconductor manufacturing capacity in any foreign country of concern for the 10-year period beginning on the date of the award.”

When violated, applicants will have to return the full amount of an award, the department said, adding it expected to publish detailed guidance on national security guardrails soon.

Samsung Electronics and SK hynix, the world’s two largest memory chip makers, have significant semiconductor manufacturing operations in China, with Samsung producing some 40 percent of its NAND flash and SK hynix manufacturing about half of its global DRAM chips in China.

In the US, Samsung is building a $17 billion chip facility in Taylor, Texas, and SK hynix has said it planned to select a site for a semiconductor packaging plant there in the first half.

Being squeezed between the intensifying US-China tech rivalry is nothing new for the two chipmakers.

Last October, Washington announced a set of measures that restrict exports of advanced semiconductor manufacturing equipment to companies in China.

The sweeping export curbs, among other things, demand companies receive a license for equipment exports to Chinese firms that make advanced chips, such as DRAM chips that are 18 nanometers and below, NAND flash chips with 128 layers or more, and logic chips 14 nm and below.

The two firms have received a one-year waiver from the U.S. government through close consultation and discussion with Washington.

South Korean’s Ministry of Trade, Industry and Energy said it will continue to closely consult with the US government to relay South Korean chipmakers’ concerns and positions on the issue.

Advertisement