Inflation to ease, economic growth to accelerate in coming months: Finance Ministry

India's retail inflation jumped in October 6.21 per cent, a 14-month high, driven by elevated food inflation in a few vegetables.

Russia was one of the biggest suppliers of gas to Europe and even Asian nations such as China and India, growth centres with their $13 trillion and $32 billion GDPs.

SNS

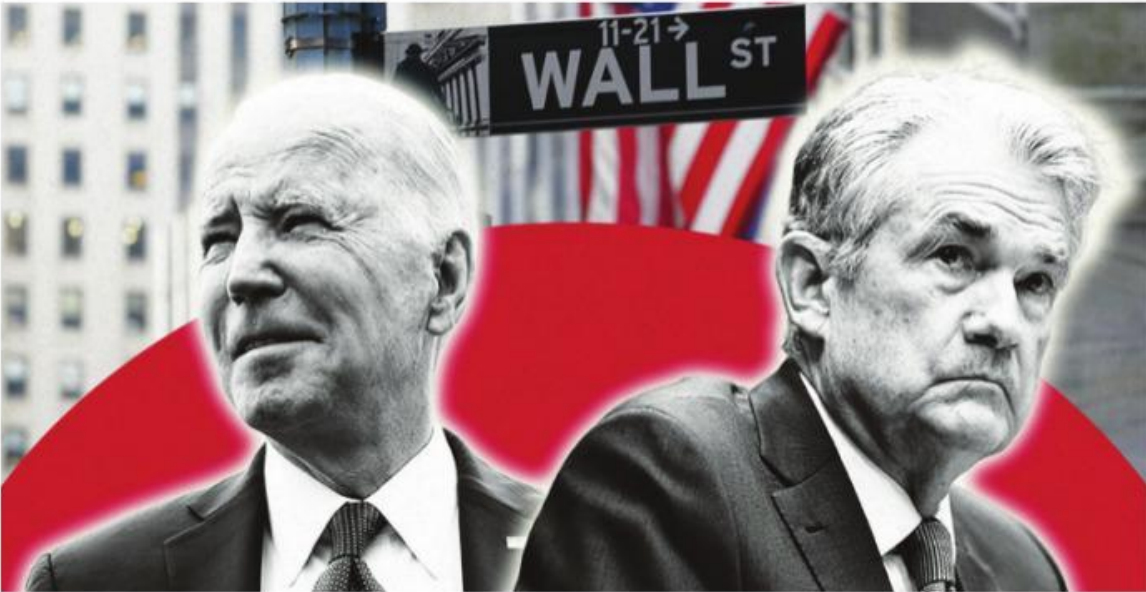

The Russian invasion of Ukraine and the US sanctions has led to a large disruption in the supply management chain and resulted in record inflation in many countries across Europe, Asia and North America. The United States seems to be the worst sufferer being a consumerist society. The worst affected countries are the United States, India and China, considered the powerhouse of the world. Here we focus on the United States alone. The data released by the federal government last Friday shows the relentless upsurge in inflation in America touching a 40 year high of 13 per cent, the highest since the Republican Reagan administration in 1980 when it touched 12.5 per cent. US economists were hoping for a turnaround in the financial health of the country but are now left reeling after seeing the Biden government release inflation data to say inflation has risen at a pace not seen in more than four decades.

Consumer prices virtually exploded by 9.1 per cent and the wholesale price index soared to 11.3 per cent. Cumulatively the overall inflation rate jumped to 13 per cent year on year (YOY) in June this year with prices of groceries, gas and some other commodities going through the roof. This is faster than April’s yearover-year surge of 8.3 per cent, the Labor Department said Friday. The cost of gas, food and other necessities jumped in May, putting large numbers of American households under severe pressure on how to manage the family budget with infants to feed (shortage of baby foods), educating teenagers through high school and undergraduate programmes in colleges.

The latest figures have crushed any hope that the worst was behind us. “So much for the idea that inflation has peaked,” Greg McBride, the chief financial analyst for Bankrate, told The New York Post. “Consumer prices blew past expectations – and not in a good way – with the annual increase being the fastest in more than 40 years. Worse, the increases were nearly ubiquitous. Just no place to hide,” said McBride. With gasoline prices up 50 per cent year-over-year, rents having increased by 31 per cent, and food prices rising at their steepest rate in more than 41 years during the same period, “any relief for household budgets remains elusive,” McBride noted. Several countries in Europe including France, Germany and UK have borne the brunt. With US sanctions, gas has become a very dear commodity and severe shortages of inputs for industry like minerals, fertilizers and others resulting in severe disruption in the demand-supply management cycle.

Advertisement

Russia was one of the biggest suppliers of gas to Europe and even Asian nations such as China and India, growth centres with their $13 trillion and $32 billion GDPs. When President Biden took Nato allies along with him to push for sanctions against Russia, he was hoping reduced export earnings would drive the country out of finances to sustain a long-drawn war with Ukraine and there would be a discussion across the table to resolve the issue. But this is the digital world, Russia had anticipated sanctions and as economists say the Putin government had allegedly banked in a new craze of crypto currencies in hidden caches across the world to insulate itself. “The idea of peak inflation assumes that our supply chain disruptions are over and won’t recur anytime soon and I’m not so sure we can be confident of that,” Nancy Davis, founder of Greenwich, Connecticut-based Quadratic Capital Management, said in an interview to the New York Post. Normally when the central bank intervenes it does so with rate increases of 25 basis points only.

This time it has been four doses of 25 basis points in 60 days, rather steep, reducing the purchasing power of the people to nothingness. “The record levels of inflation are being driven by the unprecedented easy money policy that was adopted by the Federal Reserve Bank in response to the economic downturn precipitated by the coronavirus pandemic,” Robert R. Johnson, the chairman and CEO of New York City-based Economic Index Associates, claims. “Simply put, it can be explained by ‘too many dollars chasing too few goods.” Peter Earle, a research fellow at the American Institute for Economic Research, said: “Inflation is now a front-page issue.” With the midterm polls scheduled for November this year for all the 435 seats of the House of Representatives in Congress, the Republicans are in a race to capture the house with planned attacks on the Biden government being responsible for high gas and grocery prices while Democrats are trying to flag the issue of strict gun laws and restoration of abortion rights on the ballot to retain the congress.

With Trump facing flak in the Capitol Hill insurrection probe as evidence is against him, he is also a wounded tiger, says Douglas Murry, a popular columnist. Gambling with a wounded tiger is not a good option for the Republicans as he is yielding gift after gift to the Democrats every day. But Trumpification of the party has left it with only Trump hardliners. Centrists who might have stood a better chance have been ousted. Much of the June price increase was driven by a rise in gasoline prices, which were up nearly 60 per cent over the year. Americans faced record-high gas prices last month – $6 to a gallon. The national average topped $5 a gallon. Electricity and natural gas prices also rose, by 13.7 and 38.4 per cent respectively, for the 12-month period ended in June. Overall, energy prices rose by 41.6 per cent year-over- year. The inflation rate demonstrates the health of a country’s economy.

It is a measurement tool used by a country’s central bank, economists, and government officials to gauge whether action is needed to keep an economy healthy. That’s when businesses are producing, consumers are spending, and supply and demand are as close to equilibrium as possible, economists say. When inflation is steady, at around 2 per cent, the economy is more or less as stable as it can get. Consumers are buying what businesses are selling. The fate of the US government and Biden’s governance are severely threatened by the sideeffects of the Russia-Ukraine war side effects and spiraling inflation. The sooner it is reined in, the better for the USA and the world.

Advertisement