Strike by chicken traders likely to hit supplies, price rise

With a state-wide strike called by poultry traders, supply of chickens is likely to be badly affected in the city and districts leading to its price hike.

The second price scenario is based on full tax rates, including 17 per cent GST on all products, and Rs 30 per litre petroleum levy each on HSD and petrol

Photo: IANS

Days after the exit of the PTI government, the Pakistan Oil and Gas Regulatory Authority (Ogra) suggested an unprecedented increase of up to Rs 120 per litre (over 83 per cent) in prices of petroleum products with effect from April 16 to recover full imported cost, exchange rate loss and maximum tax rates, reports said on Friday.

Highly-placed sources in Ogra and the Petroleum Division confirmed that the regulator had presented two options to the government for price increase the highest-ever in both cases on the next fortnightly review due on Friday, the Dawn reported.

Advertisement

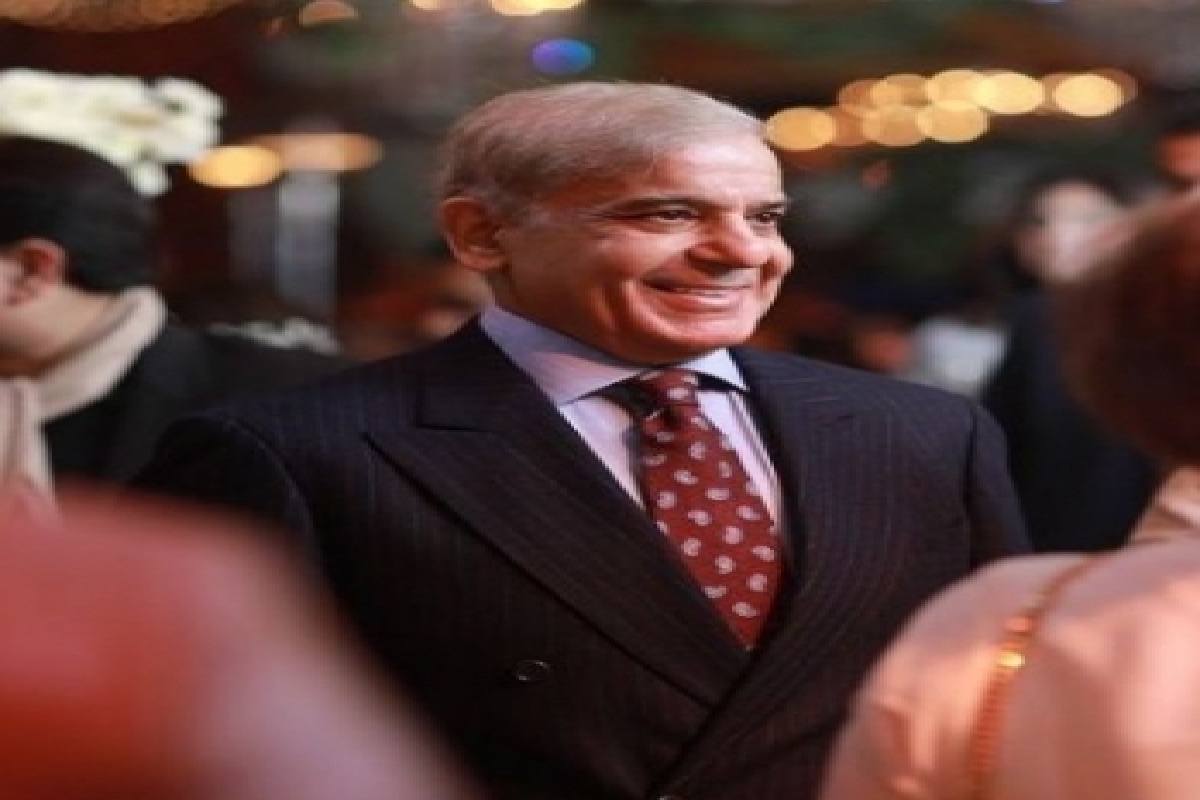

Prime Minister Shehbaz Sharif must now decide whether or not to lift a four-month price freeze (until June 30) announced by his predecessor, Imran Khan, on February 28.

Advertisement

Informed sources, however, told Dawn that the price freeze would continue for the time being.

Ogra said both options had been worked out under the PTI government’s August 24, 2020, policy guideline. This required calculations on the basis of existing sales tax and petroleum levy rates at the time of fortnightly review as well as full tax rates permissible under the law.

The Ogra’s working paper, seen by Dawn, suggests that based on the existing tax rates which are zero the prices of all products should go up in a Rs 22-52 per litre band to charge breakeven prices without any element of subsidy.

Under this option, the ex-depot price of high speed diesel (HSD) has been worked out at Rs 195.67 per litre against the existing rate of Rs 144.15, showing an increase of Rs 51.52, or 35.7 per cent. The ex-depot price for petrol will rise by Rs 21.60 (14.2 per cent) to Rs 171.46 per litre from Rs 149.86.

The second price scenario is based on full tax rates, including 17 per cent GST on all products, and Rs 30 per litre petroleum levy each on HSD and petrol, followed by Rs 12 on kerosene and Rs 10 on LDO the maximum rates permissible under the Finance Bill.

In this case, Ogra has worked out the ex-depot price of HSD at Rs 264.03 per litre against Rs 144.15 at present, showing an increase of Rs 119.88 or 83.2 per cent. Likewise, the price of petrol has been calculated at Rs 235.16 per litre for the next fortnight against Rs 149.86 at present, up by Rs 85.30 or 57.4 per cent, Dawn reported.

Advertisement