Banking Reforms

The Banking Laws (Amendment) Bill, 2024, represents a bold step to address long-standing governance, operational, and structural challenges in India’s banking sector.

If we want to have financial inclusion in real sense Banking has to be treated as a basic infrastructure like health, primary education, roads, electricity and drinking water.

[Representational Photo : iStock]

Once Mahatma Gandhi said “the soul of India lives in villages”. As per the last census (2011) 68.84 percent of India’s population (833m) live in 640867 villages.

Every economic agency has a different definition for Rural India.

Advertisement

The planning commission; the National Sample Survey office (NSSO) the NITI Ayog and the RBI treat the rural area differently.

Advertisement

All the areas not covered by Notified Area Council ( NAC), Municipal Corporation, Cantonment Area are basically rural area. We will go by definition of RBI which considers those villages with population of 10000 or less as rural. So we have 636891 villages in this category with a total population of 770 million as on 2011.

Our total population was 1210 million in 2011. The estimates for 2021 are appx 1400 million. So it is likely that our rural population, as per RBI classification, will be appx 900 million now. Thus appx 65 percent of our population are living in these 636891 villages at present.

The Govt of India and RBI have taken a series of measures during the last 75 years to improve the lots of people in villages. It all started with channelizing of credit to the neglected sectors of economy in the 60s.

Bank Nationalisation in 1969 and again in 1980, priority sector lending norms lead bank scheme in 1969, establishment of RRBs in 1975 and NABARD in 1982, Service area approach in 1989, SHG linkage in 1990 are some of the radical measures taken.

Then came the small Finance Banks ( SFB), Local area bank. In the recent past the Jandhan and other related initiatives through JAM trinity has taken financial inclusion to new heights.

All the above aimed at making banking services available to all and especially the interest of our vast rural population was always kept in mind while devising these schemes.

There have been many other developmental schemes starting with IRDP in 1978, Antodaya, MGNREGA, National Rural Mission, Pradhan Mantri Gram Sadak Yojna and Awas Yojna ,Sansad Adarsh Gram yojna etc. For the successful implementation of these schemes, among other things, we need a bank branch.

As at the end of June 2021 we have 157868 commercial bank branches out of which 52914 branches are serving in rural area. So we have one bank branch for every 12 villages and one bank branch is serving some 17000 odd villagers. At the same time there are 104954 bank branches which take care of appx 500 million SU/Urban populace. So for every 4700 people in SU/Urban area there is a bank branch. The national average is appx 8800.

No of bank branches as on June 2021 :

As is evident from the above while PSBs have over 31 percent of their branches in villages the private sector banks have appx 20 percent rural branches. The leading new generation private banks/ the most valuable banks in terms of market capitalization are thinly present in country sides.

HDFC bank, ICICI and AXIS have 18, 21 and 16 percent of their bank branches in rural area.

Its only Bandhan Bank which has 35 percent of their branches in villages (1968 out of 5548) ; better than PSB peers also! The fact remains that while appx 2/3 rd of India live in villages only one third of bank branches are there to serve them.

The total number of rural branches of all private banks put together are less than that of SBI alone; 7598 against SBI’S 7962.

We have been and we are a land of contrasts. So while a customer in city /urban area has 10/12 options to avail banking services in the countryside there is only one bank branch for every 12 villages. A villager has to travel 12 to 15 KMs to avail a loan or some other banking services.

No doubt branch banking is not the only way to avail basic banking services.

Digitisation has revolutionized our transfer and payment system. We have one of the best payment platforms globally ;in terms of safety, affordability, speed and accuracy.

True but still a vast majority of our population are illiterate; not to speak of financial literacy. Not all villages in the country have the same eco system.

If we want to have financial inclusion in real sense Banking has to be treated as a basic infrastructure like health, primary education, roads, electricity and drinking water.

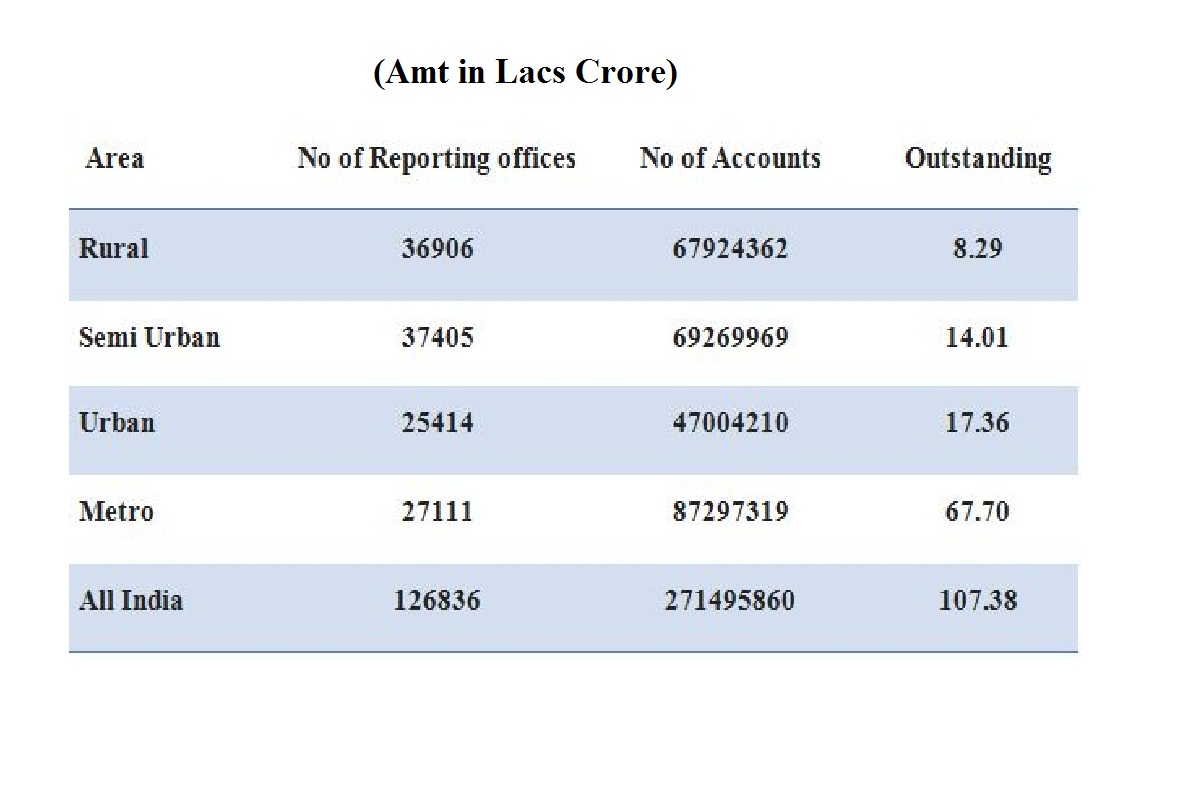

If we see the distribution of credit among rural and urban/others areas we can clearly see the divide:

Distribution of Credit limits and outstanding as on March 2021: (Amt in Lacs Crore)

Out of the 107 lacs crore credit deployed by the banking sector only 8.29 lacs core has gone to villages;(a meagre 7.72 per cent )where more than 65 percent of our people stay.

Formal banking in India is 250 years old . But banks in India started getting increasingly associated with nation building process after bank nationalisation in July 1969. Following liberalisation many new generation private banks came into being .

The PSBs / RRBS, Private Banks and more recently the the local area banks ,small finance banks are indeed doing a great job; banking the unbanked and funding the unfunded.Digitisation no doubt has brought about a revolution in our payment system and it must continue to reach out to maximum number of people.Notwithstanding these achievements there are lot of gaps which need to be covered up.

We need more bank branches and we need more bank branches in villages. I will again quote father of nation “ Sarvodaya through Antodaya “.And most of the Antodayess live in villages. Having a bank branch in a village will not solve all the problems there ; but it opens the door for hope , a hope better living .The village branch manager or bank employee is still considered a family member ,a mentor ,a friend like the health worker ,the the village school teacher, the post man! Things are changing and changing rapidly in the area of technology , delivery; but human beings are required to educate people on these changes also.Why should a villager travel 15 to 20 kilo meters to avail basic amenities .

Lets provide them this at his or her door step or at a minimum distance.

(The author is Senior Advisor, IBA. Opinions expressed are his own and don’t reflect that of IBA in any manner)

Advertisement