“US is going to hell”: Trump tears into Biden administration

The 76-year-old, who has pleaded 'not guilty' to 34 felony counts in a New York court, has also claimed that the Democrats spied on his campaign.

Coming on top of the $1.9 trillion stimulus package and $0.9 trillion approved under Trump, the US is committing $4.8 trillion or 22.9 per cent of 2020 GDP, setting the stage for Big State competition with China.

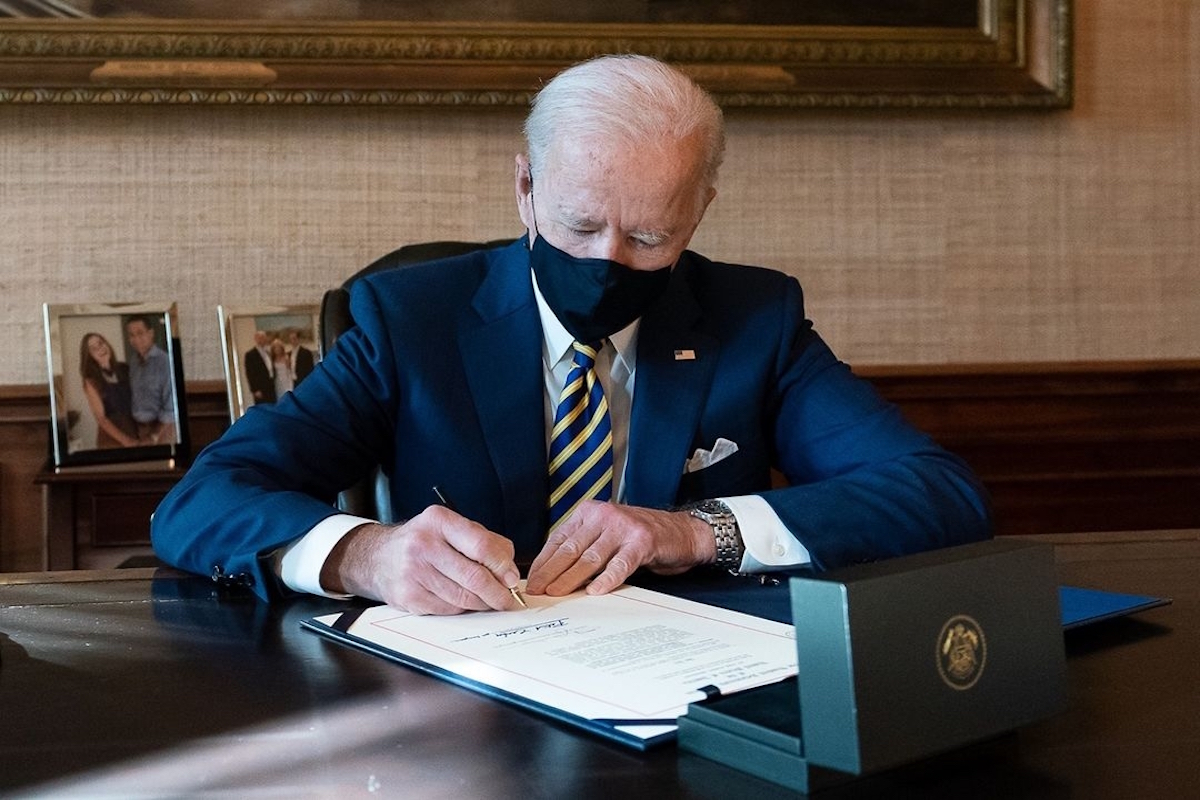

(Image:IANS)

Late last month, the Biden Administration unveiled a $2 trillion infrastructure programme that aims to modernize American infrastructure. The American Jobs Plan has four major spending components over the next eight years. First, invest $621 billion on clean energy, upgrading and repairing highways, railways, bridges and city transit systems. Second, focus $650 billion on improving life in homes, schools with water and broadband systems. Third, spend $400 billion on caregivers for elderly and disabled people to create jobs. Finally, invest $300 billion in research, development and manufacturing, including $50 billion on semiconductor manufacturing. Underlying is a strategy to deliver a green lifestyle to combat climate change.

Coming on top of the $1.9 trillion stimulus package and $0.9 trillion approved under Trump, the US is committing $4.8 trillion or 22.9 per cent of 2020 GDP, setting the stage for Big State competition with China. To fund this, the corporate tax rate would be raised to 28 per cent from the current 21 per cent, which Trump slashed from 35 per cent in his 2017 tax package. The Biden package would also plug US corporate tax evasion through capturing offshore income at domestic tax rates.

Advertisement

This attention to infrastructure and jobs is long overdue. Furthermore, the world needs this large fiscal stimulus to help global recovery from the pandemic. The OECD estimates that up to 1.5 per cent would be added to global growth from the US stimulus package.

Advertisement

The downside is whether the US can implement such investments without inflation and whether the rest of the world will fund this without higher interest rates. On inflation, LSE Professor Charles Goodhart and Manoj Pradhan have already documented that since the 1980s, global benign inflation was due to China becoming the world’s new source of cheap goods and services. They think that this will not last. University of Texas Professor James Galbraith warns that “China is missing from the Great Inflation Debate.” He however thinks that China will not rock the boat by pushing up prices.

On US debt funding, out of US net foreign liability to the rest of the world of $14.1 trillion at end-2020, just under three quarters is funded by East Asian surplus economies (Japan, China, Hong Kong, Singapore and Taiwan), with the balance by Europe (Germany, Netherlands, Norway and Switzerland). As Harvard Professor Kenneth Rogoff put it, “it seems an article of faith among US policymakers and many economists that the world’s appetite for dollar debt is virtually insatiable.”

What could totally disrupt both assumptions? Worsening US-China relations! By retaining Trump tariffs on China and hardening rhetoric on China, the Biden Administration thinks it can pump up the US and fight China and Russia at the same time.

Is this unipolar hubris justified?

The latest China Academy of Social Science (CASS) 2020 National Balance sheet report showed that by 2019, China amassed national net wealth and GDP at market value at 80 per cent and 65 per cent of the US respectively. China is a net lender to the world with $2.2 trillion or 14.4 per cent of GDP, running current account surpluses, whereas the US is net borrower to the tune of $14.1 trillion or 66.9 per cent of GDP, running growing twin fiscal and current account deficits and debt.

The real race is which form of state capitalism is more sustainable and effective – a marathon rather than a short-term dash. State capitalism has evolved from managerial and financial capitalism of recent years because financialization and technology created growing income and job disparities that only government intervention can correct. There may be ideological differences, but ideology does not ensure performance outcome.

The Chinese use state-owned enterprises (SOEs) to implement long-term national goals, such as modernization of Chinese infrastructure, stabilization of jobs, regional development and provision of social utilities. Although less efficient than the private sector, by keeping sufficient reforms to ensure profitability, SOEs contributed to China’s growing net national wealth to $88.6 trillion. With the state owning one quarter of such wealth, there is more than ample reserve to address Chinese modernization without higher taxation on the citizens. A 40-year review of Chinese SOE performance considers that SOEs are best labelled as “social enterprise”, created to achieve social goals through business methods, not wholly-for-profit.

In contrast, the combination of shareholder capitalism and frequent elections induces the US to act for short-term considerations. With contentious domestic politics and complicated Federal-State relations, infrastructure projects have hitherto faced formidable obstacles and delays. Money politics have reached the stage where everything depends on monetary creation, but that in turn relies on growing net foreign debt.

In short, one state capitalism relies on domestic savings and the other relies on foreign savings. The US has been running down its public infrastructure, because the bulk of net wealth is in private hands. In contrast, China uses SOEs to own and build infrastructure, but allows private sector to innovate and compete across usage rights. Over the last two decades, China has reduced state-ownership of assets and allowed the private sector to push market innovations. Despite criticism that privatisation was slow, sufficient SOE reforms were made to hold back growing SOE leverage and ensure that they remained profitable and delivered on national objectives.

As Jude Blanchette of CSIS argued, “Absent a deep and enduring commitment to rebuilding internal competitiveness, as well as creating an economic system that is vastly more inclusive, the United States can only tread water while China continues to march toward the future.”

As governments assume larger roles in the US, Europe and China, the issue is how to deliver performance along whole range of military, economic, social, technological and organizational dimensions, without capture, corruption, concentration and widening social injustices. So far, American free markets have allowed the 1 per cent to increase concentration of wealth and power, including capture in politics. The Achilles’ heel of procedural democracy is the enormous difficulty of reforming itself when captured.

In contrast, China seems able to lift the majority out of poverty and deliver modern infrastructure and living standards, at the cost of individual freedom. The competition is therefore between different forms of state capitalism that may in practice look like market socialism. Who wins in this competition is not about wishful thinking that the other side will collapse or falter. It’s about who makes the least strategic mistakes.

The writer is a former central banker and financial regulator. The views are entirely his own. Special to ANN

Advertisement