Forex reserves fall to over 7-month-low, current account deficit moderates: RBI

The foreign exchange reserves fell for a third consecutive week as of December 20, data from the Reserve Bank of India said on Friday.

Das said government revenues have been impacted severely due to the slowdown in economic activity amid the pandemic.

India's retail inflation at 7 pc in August; here's what experts have to say

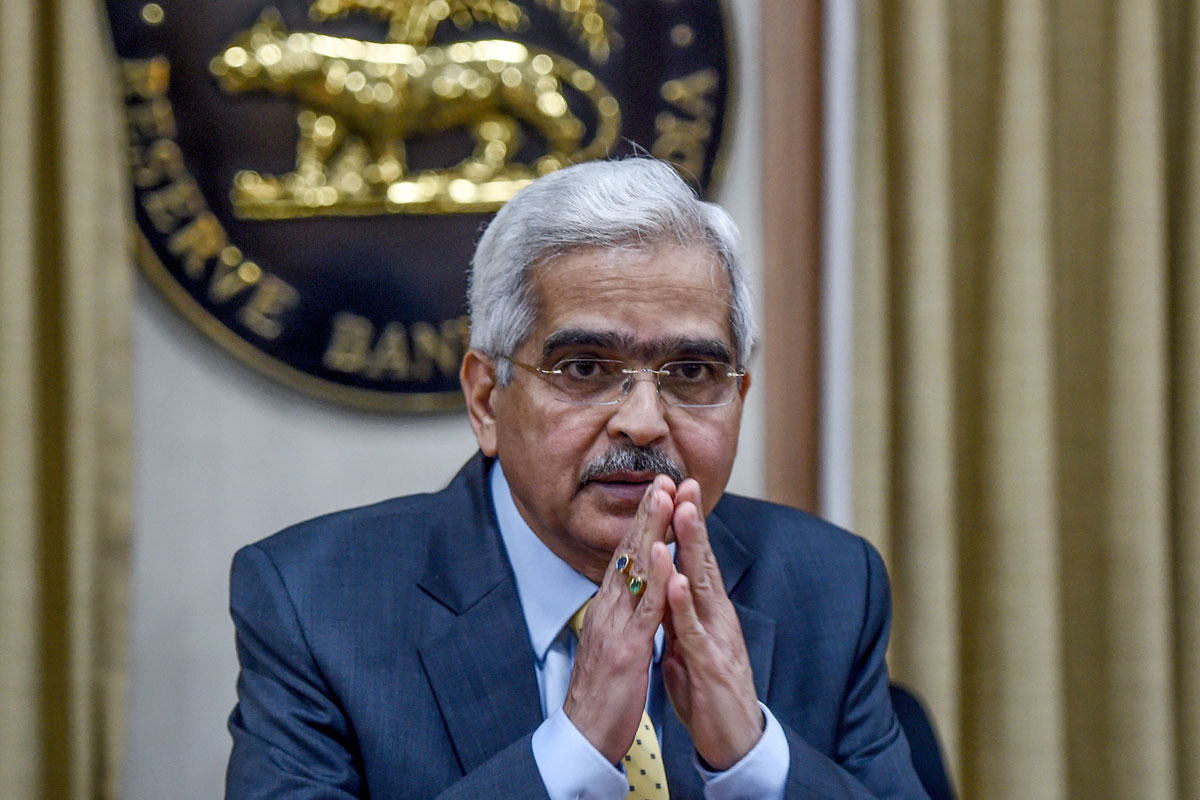

In a surprise move, the Reserve Bank of India slashed the repo rate by 40 basis points to 4 per cent from 4.4 per cent earlier. The RBI Governor Shaktikanta Das also said that the inflation outlook is highly uncertain due to the outbreak of the COVID-19 pandemic.

While addressing a digital news conference, Governor Das also expressed concern over elevated prices of pulses. He also said there is a need to review import duties to moderate prices.

Advertisement

Headline inflation may remain firm in the first half of the year and may ease in second half. Inflation may fall below 4 per cent in the third or fourth quarter of the current fiscal, said to the Governor.

Advertisement

The MPC felt that the supply shock to food prices may linger, therefore, they have called for re-appraisal of import duties.

Further, Das said government revenues have been impacted severely due to the slowdown in economic activity amid the pandemic.

He noted that the industrial production has come down by 17 per cent in March and Services PMI plunged to an all-time low in April.

He added that the exports have suffered their worst slump in three decades. April’s food inflation has jumped to 8.6 per cent. And because of the partial CPI release, the inflation outlook has become more complex.

“Deficient demand may hold down pressures on core inflation (excluding food and fuel), although persisting supply dislocations impart uncertainty to the near term outlook. However, volatility in financial markets could have a bearing on inflation. These factors, combined with favourable base effects, are expected to take effect and pull down headline inflation below target in Q3 and Q4 of 2020-21,” Das said in his address.

“Domestic economy activity impacted severely due to the 2-month lockdown. High frequency indicators point to collapse in demand. Double whammy of demand and production loss has taken a toll on fiscal measures,” noted Das.

Advertisement