New sales scheme

Government of India has reintroduced the Open Market Sales Scheme (Domestic) starting from August 2024 for Financial Year 2024-25 for price stabilization and increasing the affordability of the rice.

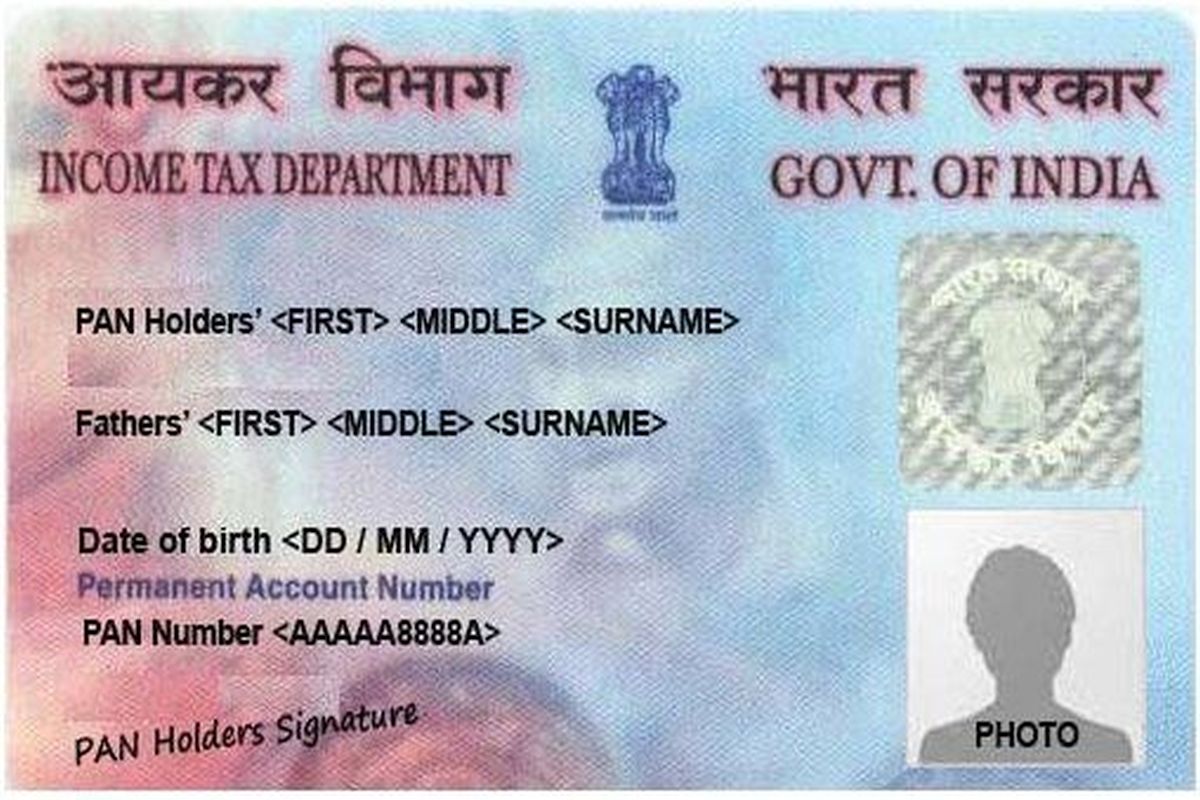

The PAN card is a valid proof of identity in India and it can be issued to citizens of India (including minors), non-resident Indians (NRIs), and even foreign citizens.

Sample PAN Card (Photo: Wikimedia Commons)

A Permanent Account Number (PAN) is an important document in India. It is used to file income tax returns, to make payments that are above the range of Rs 50,000, and even to open a bank account. The PAN card is a valid proof of identity in India and it can be issued to citizens of India (including minors), non-resident Indians (NRIs), and even foreign citizens.

These steps are for individuals only, and not for other categories under which a PAN card can be issued.

PAN can be applied online. Even if one has any request for changes or correction in PAN data, that can also be made online. Online application of PAN can be made on the NSDL website or UTIITSL website.

Advertisement

Both of these have been sanctioned by the Government of India to issue the PAN or to make changes/corrections in the PAN on behalf of the Income Tax Department. The online process is the easiest way of obtaining PAN. The applicant is only required to fill and submit the online application form along with online payment of the processing fee. Copies of the required documents can then be sent by post to either NSDL or UTIITSL for completing the verification formalities.

Steps to apply for PAN card:

Step 1: On the page linked in the previous step, you will see a form titled Online PAN application. Under Application Type select New PAN – Indian Citizen (Form 49A). If you’re a foreign national, select New PAN – Foreign Citizen (Form 49AA).Select the category of PAN card you need. For most people, this will be Individual.

Submit the PAN card application Form 49A available on the NSDL Website

Step 2: Fill all the details carefully in the form. Read the detailed list of instructions before furnishing the details in the form.

https://tin.tin.nsdl.com/pan/Instructions49A.html#instruct_form49A

Step 3: Mode of Payment

The fee for applying for PAN is Rs 93 (excluding GST) for Indians and Rs 864 (excluding GST) for foreigners. Payment of the application fee can be made through debit or credit card, demand draft or net-banking. Once your payment is successful, you will receive an acknowledgement of the same. Document this acknowledgement number carefully.

Step 4: Documents to be sent to NSDL

Once the application and payment are accepted, the applicant is required to send the supporting documents through courier/post to NSDL. Only after the documents are received, PAN application would be processed by NSDL. Documents include one document each for proof of identity, proof of address and proof of date of birth. Once you have paid, you will be asked to authenticate via Aadhaar OTP, or submit documents via e-sign, or to physically send the documents to NSDL.

The entire list of documents for the same can be found on the link below:

https://www.incometaxindia.gov.in/Documents/documents-required-for-pan.pdf

Advertisement