Zee, Sony to discuss extension of merger deadline

Zee Entertainment Enterprises said on Wednesday that Sony Pictures Networks India has agreed to discuss the extension of the merger deadline.

Blames financial mess on aggressive bets on Essel Infra, and also the acquisition of Videocon’s D2H business, besides “negative forces”

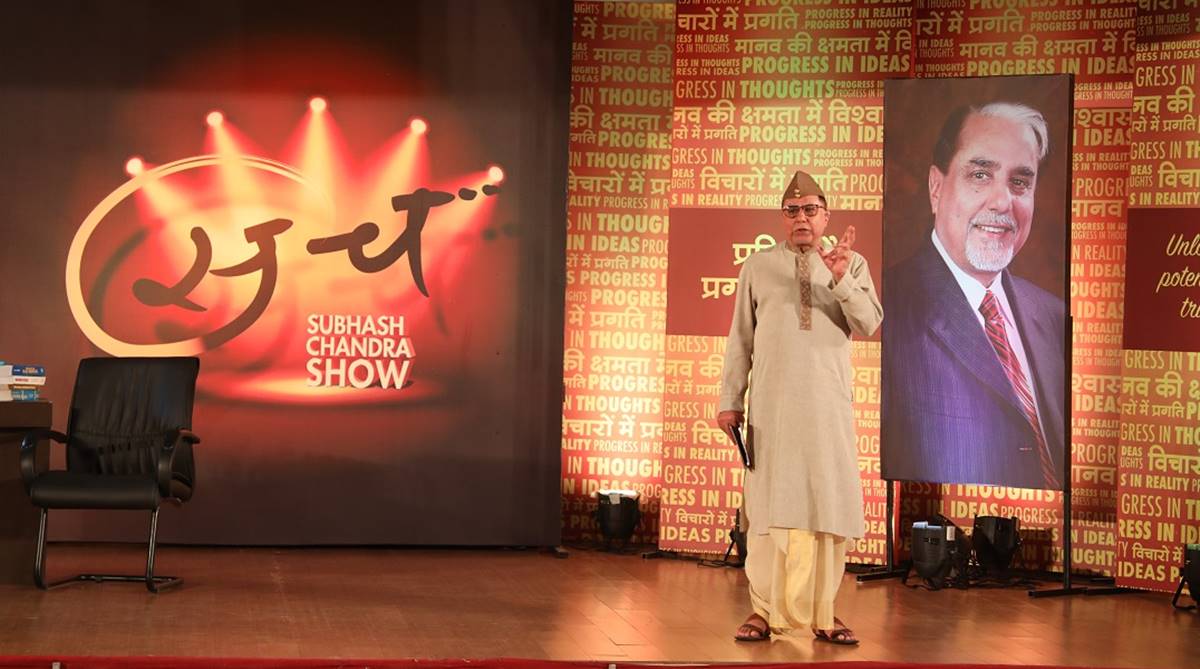

Subhash Chandra said sorry to lenders in an open letter. (Photo: Subhash Chandra Foundation/Wikimedia Commons)

Hours after Zee Group suffered losses to the tune of Rs 14,000 crore in market capitalisation after the shares of its entertainment arm massively tanked on Friday, Subhash Chandra, Chairman, ZEE & Essel Group, tendered an apology to bankers, NBFCs and mutual funds. In an “open letter” , Chandra said sorry to the creditors for “not having lived up to their expectations”, and blamed the financial mess on aggressive bets on Essel Infra, and also the acquisition of Videocon’s D2H business.

Shares of ZEE group companies plummeted up to 33 per cent, and suffered a combined loss of Rs 13,352 crore in market valuation. Dish TV shares tanked 32.74 per cent closing at Rs 22.60 on BSE. Shares of Zee Entertainment Enterprises Ltd plunged 26.43 per cent to Rs 319.35, Zee Learn Ltd tumbled 18.49 per cent to Rs 27.55 and Zee Media Corporation Ltd slumped 9.05 per cent to end at Rs 22.10.

The Zee shares tanked after a media report said its promoter company Essel Group was allegedly involved in money laundering post demonetisation.

Advertisement

Apologising to the creditors, Chandra also alleged that some negative forces were out to sabotage his efforts to raise money through a strategic sale in the Zee Entertainment Enterprises.

In the open letter, Chandra said rolling over debt had been difficult since the IL&FS crisis and the group had been able to honour its loan commitments till December.

“I am compelled to apologise to our bankers, NBFCs and mutual funds, since I believe that I have not lived up to your expectations, despite the best of my intentions,” Chandra said.

He did not say if the group had defaulted on any debt servicing commitment, but urged lenders not to react in “an anarchical manner and maintain patience” till the process of ZEE Entertainment’s stake sale was completed.

“Post-sale process, we will be positively able to repay the entire dues, but if the lenders react in panic, it will only hurt them and us,” he warned.

Mentioning “negative force”, Chandra said the troubles started in June 2018 and was followed up by anonymous letters to bankers, non-bank lenders, mutual funds, and shareholders.

He claimed that none of the operating firms of the group was facing trouble and it was only the promoters who were facing problems due to different business calls.

Admitting to some of his mistakes, he said wrong bets had caused losses to the tune of Rs 4,000-5,000 crore on Essel Infra alone.

Chandra said the decision to acquire Videocon’s D2H business in November 2016 (completed in March 2018) also cost him and brother Jawahar Goel a “fortune”.

Another “mistake”, he said, was the decision to take on the debt of all group companies during the division of the family business, adding most of the new business calls had not worked, causing debt to mount.

Chandra said he has written a number of complaints to the police, Maharashtra home minister and Sebi since November 2018, but none yielded any result.

Dear Friends,

At a very early stage of my life, I have learnt the most important lesson from my grandfather, Shri Jagannath Goenka, which taught me that a direct dialogue with the creditors should be maintained, should you find it difficult to repay any sort of loans, and this message is my earnest effort in doing so.

First and foremost, vide this message I would like to express my deepest apologies to our esteemed financial supporters. I have always been the first to accept my faults and we have been consistently accountable for the decisions taken, and I will maintain the same today as well. For the first time in my career of 52 years, I am compelled to apologize to our bankers, NBFCs & Mutual Funds, since I believe that I have not lived up to their expectations, despite the best of my intentions.

I am extremely certain that there is no promoter in India Inc., who has dared to sell the jewel of his crown, to pay off the liabilities. While the process is still ongoing, there are some forces which are not willing to see us succeed.

That said, I am not indicating that there are no mistakes done from my end, and as always, I am willing to face the consequences of the same. I assure you, that I am not running away from the core issue and will do my best to repay each and every person. The best time for the same, however, is difficult to be mentioned at this stage. I would also like to state through this message, the key points which have gone wrong:

Essel Infra: As most of the infra companies, even we have made some incorrect bids. In usual cases, Infra Companies have raised their hands and have left their lenders with non-performing assets, but in our case, My Obsession of not walking away from the situation has made me to bleed Rs 4000 crore to Rs 5000 crore. Despite the loss-making projects, we continued to pay the interest and the principle, by borrowing funds against our shareholdings in Listed Companies.

Acquisition of D2H: My recommendation made to my brother Jawahar Goel to buy D2H from Videocon was one more key error, which costed me and Jawahar both, a fortune.

When our family business separation was implemented, as the eldest member of the family, I had taken the entire burden of the debts. I believe, it was my mistake to have told myself that “Subhash you can earn and repay the creditors”. Post which, most of my bets on the new businesses have not worked, which led to the increased debt, due to the added interest levels.

The situation at hand, became further unmanageable after the IL&FS issue, came to public light. Till then, we were managing our borrowings efficiently. The IL&FS meltdown stopped the roll overs, diminishing our ability to service our borrowings.

From May / June 2018 onwards a negative force which was acting against our grip as promoters became strongly active. This was followed by some anonymous letters being sent to all Bankers, NBFCs, Mutual Funds, Shareholders, etc.

Whenever we have reported some really good results from the operating Companies, the share prices were intentionally hammered by these negative forces, driving away the investors.

While the above, are the reasons of the current situation, I must also mention what steps were taken from our end:

We wrote a number of complaints to the Department of Police, Home Minister of Maharashtra, SEBI and other concerned authorities, right since November 2018, but all the efforts did not result in any action.

Till December, we continued to pay the due interest and principle, to all lenders.

I have also given my best to expedite the stake sale of ZEE Entertainment. Infact, I have just returned back from London, last night itself, after a series of positive meetings with potential suitors.

The mentioned negative forces, possibly after getting a hint of these positive meetings, have attacked the share price today, with a clear intention of sabotaging ZEE Entertainment’s strategic sale process.

I must also mention that there is no systematic protection against the insidious attack on us by the mentioned negative forces, but we will continue to seek the support of the system in order to thoroughly investigate the matter.

About the Operating Companies:

All Operating Companies, especially our most precious one which is ZEE Entertainment, are performing exceptionally well and are under NO stress whatsoever. The debt burden is purely at the promoter level, which is reflecting negatively on the Companies.

I would like to reiterate that ALL the Companies are performing exceptionally well and there is no problem whatsoever.

Having said the above, I still believe, strongly feel and would like to urge the lenders, not to react in an anarchical manner and to maintain patience, till the process of ZEE Entertainment’s stake sale is completed. Post the sale process, we will be positively able to repay the entire dues, but if the lenders react in a panic situation, it will only hurt them and us.

I would again like to reiterate that I have no intention whatsoever, to keep a single rupee, till all the dues to the lenders are paid.

Yours truly,

Subhash Chandra

(With agency inputs)

Advertisement