Shaktikanta Das hospitalised, RBI says ‘no cause for concern’

The Reserve Bank of India (RBI) Governor Shaktikanta Das was hospitalised here earlier in the day with a minor health issue. The Central Bank said that “there is no cause for concern”.

Euronet Services India Pvt. Ltd. Managing Director Himanshu Pujara said unless all the ATMs are recalibrated, the new notes will not be available.

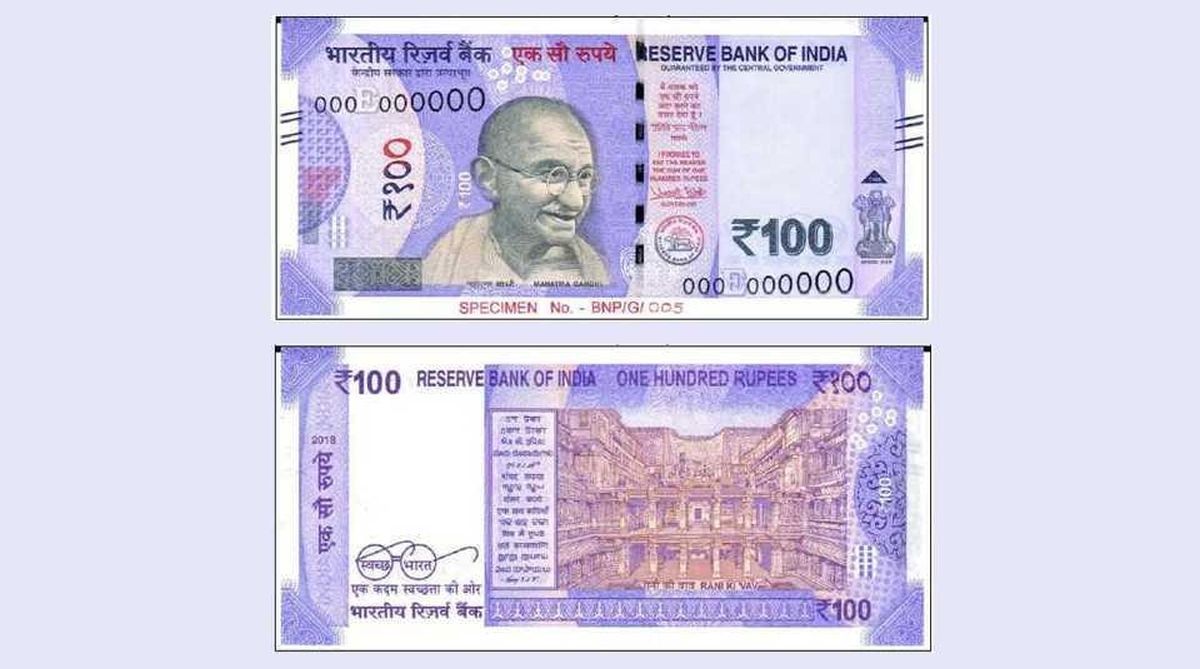

The new 100-rupee denomination notes have been greeted with trepidation by major companies engaged in the manufacture and supply of ATMs in the country. (Photo: RBI)

The Reserve Bank of India’s (RBI) announcement launching a new series of Rs 100 notes has been greeted with trepidation by major companies engaged in the manufacture and supply of Automatic Teller Machines (ATMs) in the country.

Like the new post-demonetisation Rs 2,000, Rs 500, Rs 200 and the new Rs 50 notes and Rs 10 notes, even the new lavender-coloured Rs 100 is a tad smaller in size compared to the blue-coloured Rs 100 notes currently in circulation.

While the existing Rs 100 notes are sized 157×73 mm, the new ones measure 142x66mm, as per the RBI announcement this week.

Advertisement

“This means that all the 237,000 ATMs in the country would again have to be re-calibrated to dispense the new Rs 100 notes. This entails a massive effort which is both time-consuming and adds to our costs,” Confederation of ATM Industry (CATMi) Director V. Balasubramanian told IANS.

For recalibrating all the ATMs in the country to enable them dispense the new Rs 100 notes, the operators need the concerned bank’s official Cash Agency and an engineer of the machine manufacturer together.

“Though the actual recalibration may take barely 20 minutes per ATM, there are huge logistical issues involved in getting the Cash Agency person and engineer together all the time. Even then, with best efforts they can recalibrate barely 15-20 ATMs per day depending on the banks’ cooperation. So, this will be a huge time-consuming and high-cost exercise at a national level,” Balasubramanian rued.

Hitachi Payment Services Managing Director Loney Antony estimates that the entire recalibration process could cost over Rs 1 billion (Rs 100 crore) and take a minimum of one year to complete.

“In fact, the recalibration of the new Rs 200 notes introduced last year is still not completed in all ATMs, so recalibration of the new Rs 100 notes could take even longer unless planned properly,” Antony cautioned.

The RBI said in its notification that initially, the new Rs 100 notes will be dispensed only through bank branches and printing and supply would gradually increase.

Antony said it is important to have sufficient supply of Rs 100 and Rs 200 notes to ensure there are enough lower denomination currency notes in circulation for all transactions.

Balasubramanian said the ATM industry is grappling with the problem of how to recalibrate the ATMs in terms of the new and old Rs 100 notes and may refrain from doing so till sufficient numbers of the new notes are available.

Euronet Services India Pvt. Ltd. Managing Director Himanshu Pujara said unless all the ATMs are recalibrated, the new notes will not be available through this channel to the people, and recalibration itself is a time-consuming and expensive process for the already struggling industry.

Balasubramanian — who is also the President of FSS Company that manufactures ATMs — said that since the old and new Rs 100 notes will co-exist till the RBI completely withdraws the old notes, “it will be difficult to recalibrate all the ATMs to support the new Rs.100 notes”.

“There is likelihood of an imbalance between the supply of the new notes and the withdrawal of the old notes, especially in the hinterland,” Balasubramanian pointed out.

In such a scenario, he thought it would be prudent to let the banks and service providers decide when to calibrate the ATMs for the new notes, depending on the “supply-withdrawal” situation of the old notes across all states over the next few quarters.

At present, as per National Payments Council of India Ltd (NPCIL), there are around 237,000 ATMs functional in the country, but to adequately cater to the entire country’s population, the need is almost three-four times more, or around a million ATMs.

Flying in the face of the government’s declarations about digitising the economy, a whopping 57 percent of all ATM transactions are only for cash withdrawals. Immediate Payment Service (IMPS) lags at 20 per cent followed by Point of Sale (PoS) 17 percent, and rest for Unified Payment Interface and mobile wallets. (Total = 100 percent, as per RBI).

Major industry players say that, barring the metros and urban centres, people in states like Uttar Pradesh, Maharashtra, Bihar, West Bengal, Madhya Pradesh and others have to travel 40 km or more to access an ATM.

“Moreover, as per official data, barely 30 per cent of bank account holders in the country regularly use their ATM cards… the others prefer cash transactions. There are problems of infrastructure and connectivity which hamper growth of ATMs network,” Balasubramanian pointed out.

India has among the lowest ATM penetration globally, averaging 8.9 ATMs per 100,000 population, compared to Brazil’s 119.6, Thailand’s 78, South Africa’s 60 and Malaysia’s 56.4.

Incidentally, China currently has around a staggering one million ATMs, which will touch 1.5 million by 2020.

Advertisement