HDFC Bank’s M-cap touches Rs 14 trillion for first-time ever

The market capitalization (market cap) of HDFC Bank topped the Rs 14 trillion mark for the first-time ever on Thursday.

Intraday

Mahindra and Mahindra, India’s top tractor manufacturer and also SUV maker, on Tuesday became the second most valued auto company as its market capitalisation surpassed Rs 1 trillion or Rs 1 lakh crore intra-day when its stock surged to a fresh 52 week high of Rs 819.10 (+2.23 per cent) and `Rs 818.80 (+2.16 per cent) on Bombay Stock Exchange and National Stock Exchange respectively.

M&M with m-cap of Rs 1.01 trillion has moved way ahead of Tata Motors, Eicher Motors and Bajaj Auto as it now stands second to Maruti-Suzuki which has m-cap of Rs 2.77 trillion.

Advertisement

Analysts say of the 42 brokerages polled by Bloomberg 40 have recommended “buy” rating for M&M while two have suggested “hold”.

Advertisement

Mahindra is expected to grow faster in current fiscal 2018-19 on rising demand for tractors. say analysts, citing significantly higher spending by the government to boost rural and farm economy as proposed in this year’s budget.

Mahindra share hit a record high a day after the IMD released its first forecast of the monsoon.

Average rainfall will increase demand for tractors. Mahindra’s share in this segment is more than 42.9 per cent. In March the company had sold 28,277 units — a jump of 46.25 per cent — against 19,337 in the same month last year. In FY 18 its total sale exceeded three lakh tractors.

Brokerage Jefferies said India’s M&M is trading at 12 times of its one year forward estimates which is at significant discount to its peers.

Mahindra is yet to declare its Q4 earnings, but Japan’s Nomura estimates increase in the revenue by 27 per cent. Industry analysts say its SUV models too are doing fairly good business.

The market is moving ahead keeping pace with the consumers’ demand.

Tata Motors, analysts say, may not manage to meet the market’s estimates (earnings) due to slump in its flagship revenue and profit earner JLR or Jaguar Land Rover, a British subsidiary.

Reports suggest JLR is likely to trim or not renew about 1,000 employees’ contract. However, overall, auto segment is likely to rise steadily particularly in passenger car segment and two-wheelers (again on rise in rural demand).

Meanwhile, the 30-scrip Sensitive Index of BSE and 50-share Nifty of NSE traded within a range on Tuesday with a mid-day spell of volatility that dragged them into negative terrain.

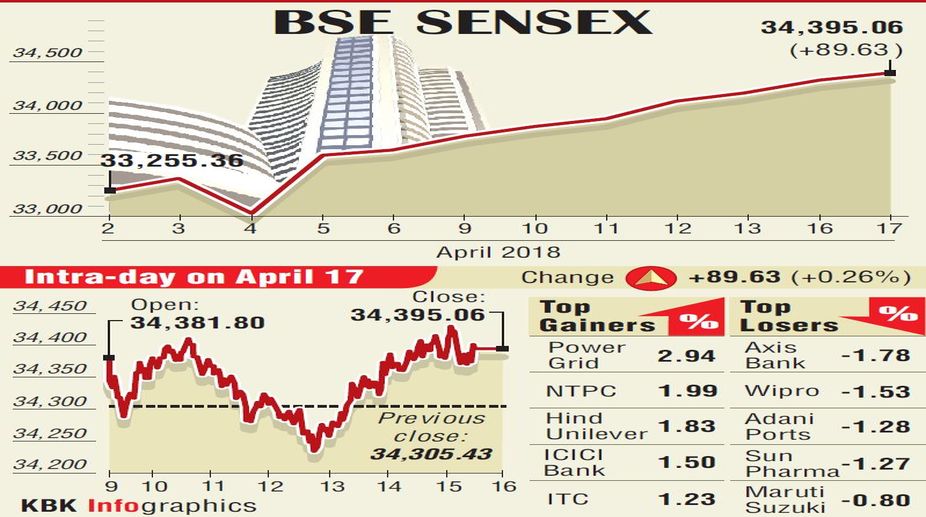

The benchmarks recovered and extended gains for the straight ninth session mainly on gains in auto, FMCG, energy and few private bank shares. Sensex closed 0.26 per cent up at 34,395.06 (+89.63) points. Nifty at 10,548.70 (+20.35) points gained 0.19 per cent. Nifty Bank closed 25,334.45 (+13.60) points up 0.05 per cent. In Sensex 15 shares gained and 16 were down. For Nifty the ratio was 23:27.

Disappointing numbers by Infosys Technologies resulted in further decline in the stock price intra-day. IT sector index too traded with downside bias in morning deals.

Hong Kong based CLSA’s global strategist Christopher Wood who was in Mumbai to attend an event and he predicted volatility in stock business due to several global factors.

CLSA had reported a few weeks ago that Nifty, the broader market’s benchmark, had little chance to cross the 11,000-mark in the rest of 2018. Commenting on beleaguered two private lenders ICICI Bank and Axis Bank, Wood likened them to “pseudo private banks” apparently due to allegations of nepotism against ICICI Bank CEO and MD Chanda Kochhar and mounting NPAs in case of Axis Bank which is beset with governance issues.

However, the two lenders are likely to increase their market share at the cost of state-run lenders, he predicts. On economy’s growth Wood sees “a real possibility” of revival of private sector’s capital expenditure in India.

As the earning season rolls on, the market looks ahead to Reliance Industries Limited’s numbers for January-March quarter amid high expectations of the company declaring net profit in excess of Rs 100 billion and more than Rs one trillion revenue. Bloomberg poll suggests consolidated profit at `95 billion and revenue at Rs 1.15 trillion.

Main contributors to continuing better earnings would be GRM (gross refining margin) in double digit ~that is above $10 /barrel) and income from telecom (Jio) business ably assisted by retail segment.

The gainers in BSE benchmark included Power Grid Rs 205, 2.99 per cent; HUL Rs 1,450, 2.13 per cent; NTPC Rs 177.10, 1.06 per cent; Bharti Rs 382.90, 1.61 per cent; and M&M Rs 809, 0.97 per cent.

Advertisement