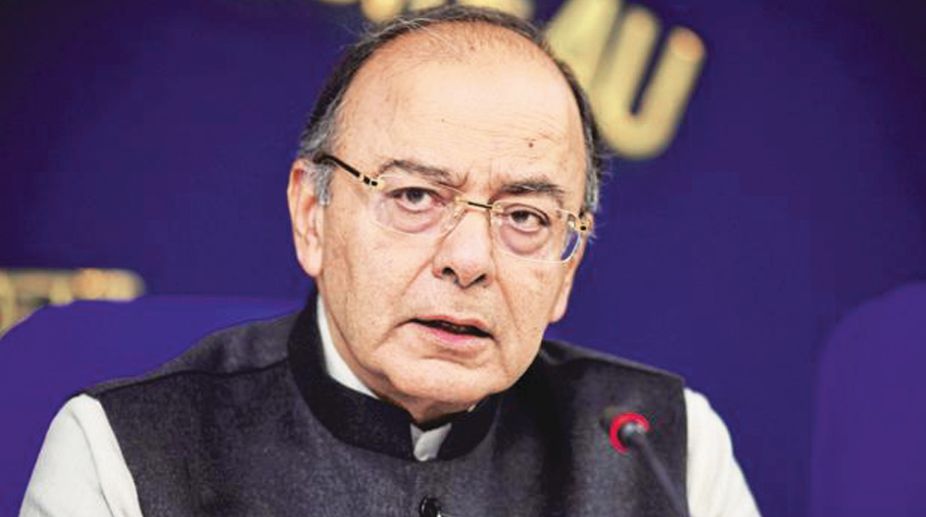

In the wake of the Rs 12,600 crore fraud on state-run Punjab National Bank (PNB) by accused diamantaire Nirav Modi, Finance Minister Arun Jaitley said on Thursday that the highest levels of integrity and efficiency are required from personnel of the Civil Accounts Service in view of the great sanctity attached to the accounting system.

Addressing the 42nd Civil Accounts Day function here, the Finance Minister also said there is no scope for error in the accounting system.

Noting that the effective use of technology is helping the accounting system by making tasks easier, Jaitley exhorted Indian Civil Accounts Service personnel to maintain the highest standards of efficiency and accuracy.

“We have to keep pace with these changes and maintain the highest level of the accounting system,” he said.

Last week, Jaitley had criticised regulators, as well as bank managements and auditors, for their failure to detect bank frauds saying “politicians are accountable but regulators are not”.

“What are our auditors doing? Both internal and external auditors really have looked the other way or failed to detect,” he said at an event in New Delhi, without naming the PNB scam.

“I am sure the profession of Chartered Accountants and those who control the discipline of the profession will start introspecting and see what are the legitimate actions which are to be taken,” he added.

At the Civil Accounts Day event, Jaitley also said that revolutionary changes in policy have been introduced by the government like Direct Benefit Transfer (DBT), the Goods and Services Tax (GST) and in the direct tax system.

“The Integrated GST (IGST) being distributed between the Centre and the states is being done in a manner where nobody can ever raise a question, while this entire revolutionary change which can be made on account of DBTs which manages to ensure that the pipeline of pass-through directly to the beneficiary itself is maintained,” said Jaitley.

“I think these are important changes with which the entire system itself is now adjusting to,” Jaitley said.

Following the PNB scam that has rocked the banking system, Indian industry has called for better and hi-tech control systems to check financial frauds as also a gradual decrease in government holding in public sector banks.

“The three key solutions for the banking sector are better management and operational efficiencies, use of technology such as blockchain and big data analytics, and lowering of the government shareholding in public sector banks,” Industry Chamber CII President Shobana Kamineni said in a statement in New Delhi on Sunday.