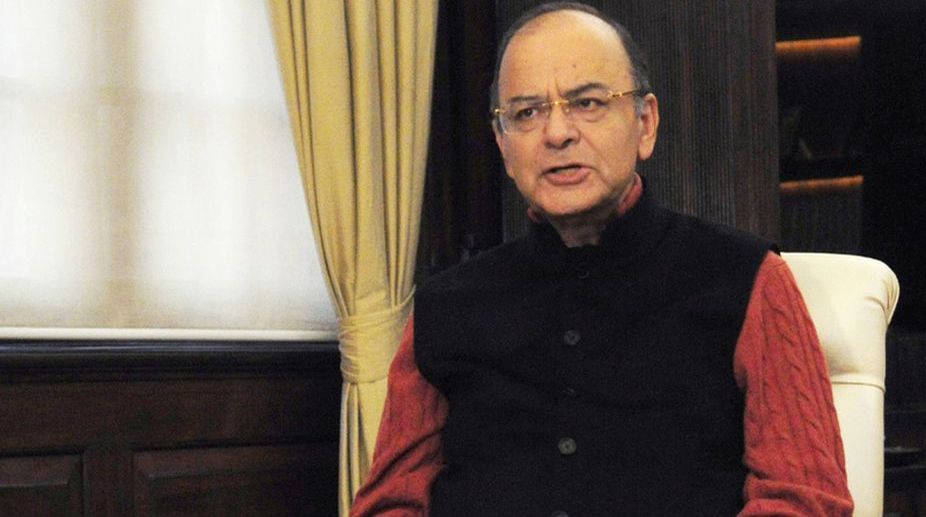

Employment creation, the global slowdown in investments and the possible impact that the US Federal Reserves move normalise monetary conditions can have on emerging economies are three major policy challenges, Finance Minister Arun Jaitley has said.

“The risks posed to emerging markets and developing economies by the US Federal Reserve’s steps towards restoring normal monetary conditions, the global slowdown in investments and employment are the three policy challenges,” Jaitley said at a discussion here of the International Monetary and Finance Committee (IMFC), according to a statement from the Finance Ministry on Sunday.

Advertisement

Monetary policy tightening in the US could cause capital outflows from emerging economies affecting their current account deficit, he said.

Jaitley also said the highest priority for the government is to create new jobs as millions of young people enter the workforce every year.

“India is currently one of the few large economies in the world in the virtuous phase of its demographic transition and the most important priority of the government is to find ways to provide employment to the 12 million young people entering the workforce annually,” he said.

Jaitley, who led the Indian delegation to the annual meetings of the International Monetary Fund and the World Bank, said the short-term adverse impact of the Goods and Services Tax GST and demonetisation have been mostly overcome.

“Recent data in manufacturing sector indicate that India’s growth story is soon getting back to its normal course,” he said.

Addressing the annual meetings of the IMF and the World Bank here on Saturday, he called for urgent revision of the IMF quota in favour of dynamic emerging markets so as to reflect the ground realties of the world and hoped this could be accomplished as part of the 15th General Review of Quotas.

“There is an urgent case for revising quota shares in favour of dynamic emerging market countries in line with global economic realities to maintain fairness in the governance structure of the Fund,” he said.

“We should make every effort to complete the 15th Review by the agreed timeline of 2019 Annual Meetings,” he added.

Regarding the World Bank Group, Jaitley said the unanimously agreed Lima Roadmap had earlier envisaged a conclusion of the 2015 shareholding review by the Annual Meetings 2017.

“While we note that we failed to deliver it, given the progress that has been made so far, we strongly urge all to commit to deliver an equitable conclusion of this process for both the IBRD and IFC by the Spring Meetings 2018,” he said.

“We look for an expeditious decision on capital enhancement through both selective capital increase (SCI) and general capital increase (GCI) for both the IBRD and IFC, by Spring Meetings 2018,” he added.

The Indian Finance Minister warned that sudden reversal of monetary accommodation by advanced economies could increase policy strains in emerging markets and developing economies (EMDEs).

“The risks of growing populism and consequential loss in trade volumes will affect global recovery adversely, and it is incumbent upon all of us to foster cooperative multilateral efforts to boost fair trade practices,” he said.