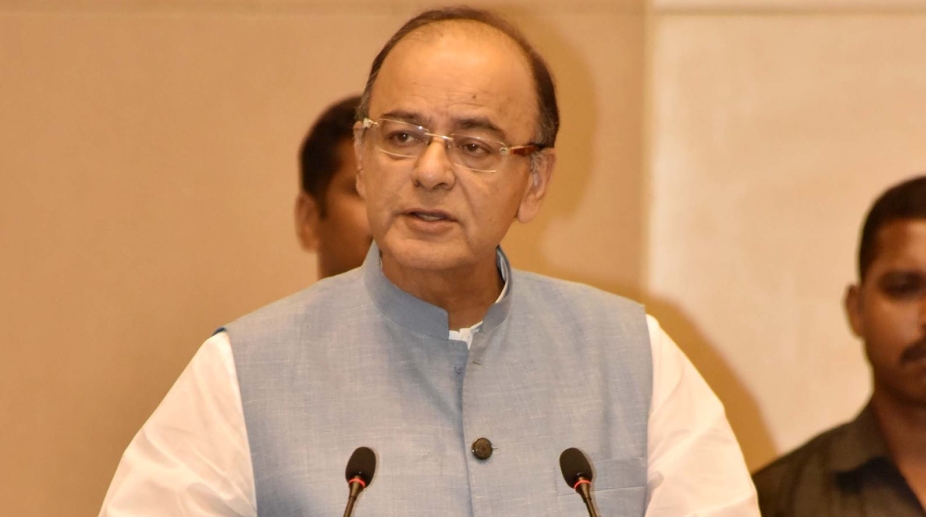

The Jan Dhan, Aadhaar and Mobile (JAM) trinity has ushered in a social revolution which will bring all Indians into a common financial, economic and digital space, Finance Minister Arun Jaitley said on Sunday.

“Just as GST created one tax, one market, one India, the PMJDY (Pradhan Mantri Jan Dhan Yojana) and the JAM revolution can link all Indians into one common financial, economic and digital space. No Indian will be outside the mainstream,” Jaitley posted on his Facebook account on the third anniversary of the PMJDY.

Advertisement

“Within reach of the country is what might be called the 1 billion-1 billion-1 billion vision. That is 1 billion unique Aadhaar numbers linked to 1 billion bank accounts and 1 billion mobile phones. Once that is done, all of India can become part of the financial and digital mainstream.”

JAM offers substantial benefits for the government, the economy and especially the poor, as well as weeds out leakages from the subsidy system, the Finance Minister said.

The government currently makes direct transfer of Rs 74,000 crore to the accounts of 35 crore beneficiaries annually, at more than Rs 6,000 crore per month.

These transfers are made under various government anti-poverty and support schemes such as PAHAL, MNREGA, old age pensions and student scholarships, Jaitley said.

PMJDY accounts increased from 12.55 crore in January 2015 to 29.52 crore as of August 16, while the number of RuPay cards issued increased from 11.08 crore to 22.71 crore in the same period.

The number of rural accounts opened under PMJDY has grown from 7.54 crore to 17.64 crore, and the average balance per account increased from Rs 837 to Rs 2,231 as of August 16.

Total balance in beneficiary accounts rose to Rs 65,844.68 crore, while zero balance accounts declined from 76.81 per cent in September 2014 to 21.41 per cent in August 2017, Jaitely said.

Referring to seeding of Aadhaar with bank accounts, Jaitley said that about 52.4 crore Aadhaar numbers were linked to 73.62 crore accounts.

“As a result, the poor are able to make payments electronically. Every month now, about seven crore successful payments are made by the poor using their Aadhaar identification,” he said.

Besides, with the launch of the BHIM app and the Unified Payments Interface, JAM has become fully operational, he added.

“A secure and seamless digital payments infrastructure has been created so that all Indians, especially the poor, can become part of the digital mainstream,” he said.

The government has also taken steps to provide security to the poor through life insurance under the Pradhan Mantra Jeevan Jyoti Bima Yojana (PMJJBY) and accident insurance Pradhan Mantra Suraksha Bima Yojana (PMSBY).

As on August 7, total enrolment was 3.46 crore under PMJJBY and 10.96 crore under PMSBY with 40 per cent of the policy holders being women in both the schemes.