Good Governance Award Scheme by Haryana to recognize outstanding public service

The state government has notified the ‘Haryana Good Governance Award Scheme 2024’ (Haryana Sushaasan Puraskaar Yojana 2024).

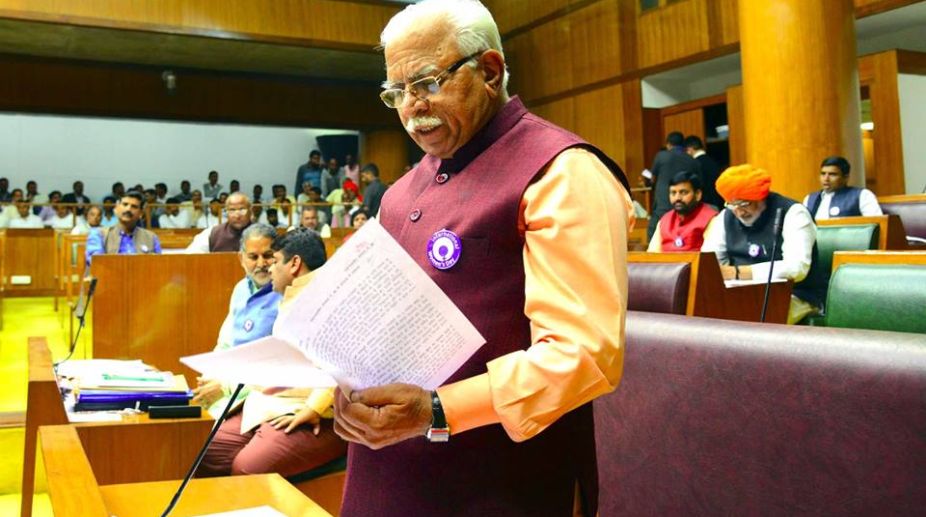

Haryana CM Manohar Lal Khattar (PHOTO: Facebook)

In a major policy decision, the Haryana government on Tuesday has decided to provide accidental insurance cover to all residents of Haryana in the age group of 18 to 70 years under the ‘Pradhan Mantri Suraksha Bima Yojana’ (PMSBY) Scheme. The premium would be reimbursed by the state government.

A decision to this effect was taken at the Cabinet meeting held under the chairmanship of the Chief Minister Manohar Lal Khattar. The sum insured would be Rs.2 lakh each in case of accidental death, and, in case of total and irrecoverable loss of both eyes or loss of use of both hands or feet or loss of sight of one eye and loss of use of hand or foot due to accident.

Similarly, it would be Rs.1 lakh in case of total and irrecoverable loss of sight of one eye and loss of use of one hand or foot due to accident. The scheme would be an accident insurance scheme with one year cover, renewable from year to year, offering accidental death and disability cover. The scheme would be offered through banks and administered through public sector general insurance companies and other general insurance companies.

Advertisement

All resident of Haryana having Aadhaar seeded saving bank accounts, in the age group of 18 to 70 years, would be entitled to join the scheme. Aadhaar would be the primary KYC for the bank account and insurance coverage. The cover would be for one-year period stretching from June 1 to May 31. Consent form to join, pay, auto-debit from the designated savings bank account on the prescribed forms will be required to be given by the beneficiary by May 31 of every year. However, applicants may give an indefinite or longer option for enrollment or auto-debit.

In the first instance, the premium of Rs.12 per annum will be deducted from the account holder’s savings bank account through ‘auto-debit’ facility in one instalment on or before June 1 of each annual coverage period under the scheme, which, in turn, will be reimbursed by the state by direct credit to the beneficiary account on receipt of information from bank.

The accident cover for the member would terminate on attaining the age of 70 years or closure of the account with the bank or insufficiency of balance at the time of renewal to keep the insurance in force.

Similarly, if the insurance cover is ceased due to any technical reasons, the risk cover will be suspended and reinstatement of risk cover will be at the sole discretion of insurance company. Participatory banks will deduct the premium amount in the same month when the auto-debit option is given, preferably in May of every year, and remit the amount due to the insurance company in the month itself.

With implementation of the PMSBY, the existing ‘Rajiv Gandhi Parivar Bima Yojana’ will have ceased from March 31, 2017. The date of commencement of the scheme will be June 1, 2016 and beneficiaries who have enrolled themselves during the year, that is, June 1, 2016 to May 31, 2017, will be entitled to get the reimbursement of premium. The next annual renewal date would be each successive June 1 in subsequent years.

Advertisement