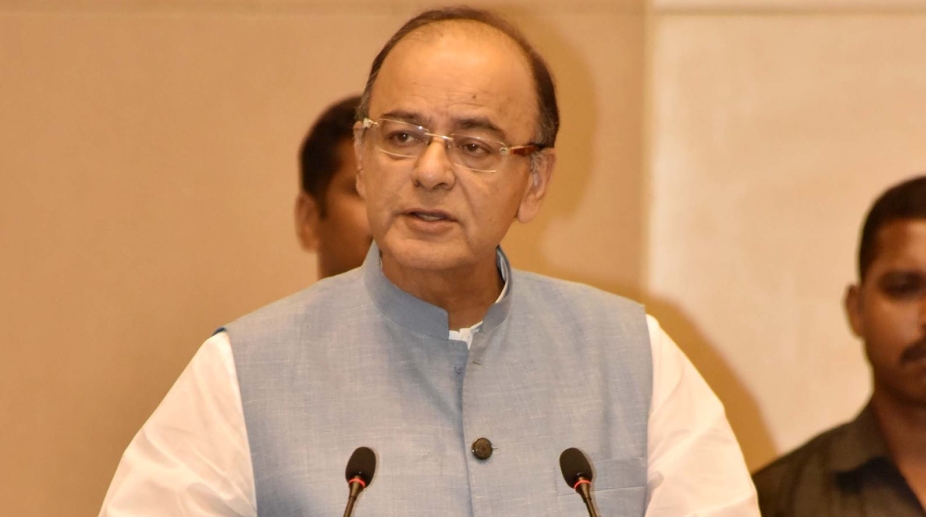

In its pre-budget proposals, PHD Chamber of Commerce and Industry has asked Finance Minister Arun Jaitley to restrict corporate tax at 25 per cent with cesses and surcharges from 2017-18.

"Corporate tax rate should not be more than 25 per cent from the headline rate of 30 per cent and 34.6 per cent with cesses and surcharges," PHD Chamber said in its budget proposals that were submitted to the Finance Minister here on Saturday.

Advertisement

It also suggested an increase in the rebate on interest paid on housing loan by Rs 1.5 lakh from fiscal 2017-18 with a special provision in the forthcoming budget through which lending to micro-small and medium enterprises by Non-Banking Financial Company (NBFCs) could be brought in priority sector.

The Chamber argued that time has come to increase the rebate on interest paid on housing loan from the current level of Rs 2 lakh to Rs 3.5 lakh as it would boost demand in the real estate and construction and also spur up economic sentiments with positive multipliers.

While appreciating the incentives given on promoting cashless transaction, PHD Chamber President Gopal Jiwarajka suggested that RTGS and NEFT transfers should be free of transaction costs.

As Goods and Services Tax (GST) is heading towards implementation, the industry body suggested that its peak rate should be moderated to the level of 20 per cent.

"With GST becoming reality by July 2017, the indirect taxation would be rationalised to a large extent but urged the government that its peak rate should be moderated to the level of 20 per cent," Jiwarajka said.

"The show cause notice should also be retained at 18 months instead of 36 months. Anti-profiteering clause should also be removed from GST," he added.

The Chamber also demanded that banks should be allowed to provide funding for domestic mergers and acquisitions and effective transmission of the monetary policy is required so that the benefits of rate cuts are percolated towards beneficiaries.